White paper

Rootstock brings a solution to this by offering almost instant transaction validation (20 seconds) and asset issuing with prices pegged to that of a fiat currency or other stable commodity. Lowering volatility exposure in transactions while keeping bitcoin as a reserve currency increases overall bitcoin value.

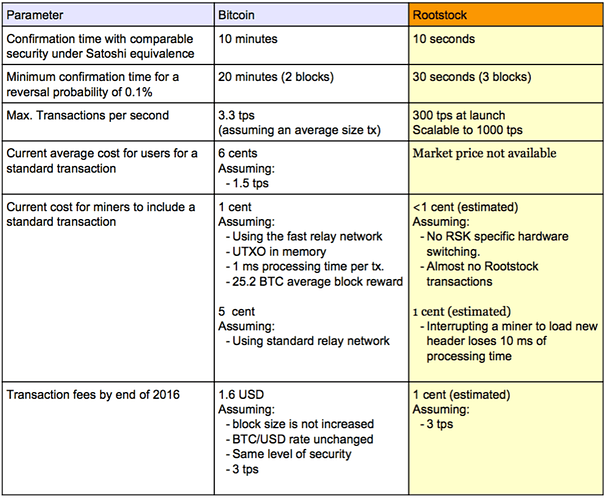

Is important to note from the above chart that transaction fees estimations are based on the unproven fact that the BTC price will remain at approximately 240 BTC/USD during 2016. If the price increases ten-fold during this period, then also will the transaction fees, rendering Bitcoin Blockchain viable as an inter-banking clearing system, but not a payment network. Also is important to note that off-chain payment systems can emerge, providing cheaper payments, but at the same time centralizing the network, and changing its decentralized nature.

VISA handles nearly 10,000 TX per second, we should develop a semi-centralized system, the signers pool to handle 10 even 100 times TX of VISA, and beat any traditional (VISA/MASTER) or blockchain based system(BTC, Ethereum, Rootstock)!

3 Likes

Open transaction has already found out that the “voting pool” can handle lots of TX per second than blockchain resolution.

And the quick wallet, also has implement multi sig wallet

https://quickwallet.com/help

How Is Quickwallet Quick?

-

Because all Quickwallet transactions require two private keys, one of which we hold, it is impossible for a user to double spend.

-

Therefore, transactions between Quickwallet users can be confirmed instantly, without having to wait for confirmation on the blockchain.

I hope in future, the B&C account is also a wallet account, and transactions between B&C users can be confirmed instantly, with one million TX per second treatment reached. Because there is no upper limit of B&C signer quantity. Thanks for the PoS Cryptocurrency tech. We naturally have much lower cost than VISA centralized servers or BTC decentralized minting rig when confirming transactions.

What’s the best solution of payment? Perhaps the answer is neither 100% centralized nor 100% decentralized: semi-centralized, with blockchain as its settlement network. Of course, without block size bloat!

VISA’s tool:

BTC’s tool:

B&C signers’ tool:

We will win the cost war.

4 Likes

Talking about “competitors”, I guess I found another one today:

http://usdplus.co/

NXT based.

Too weak IMO.

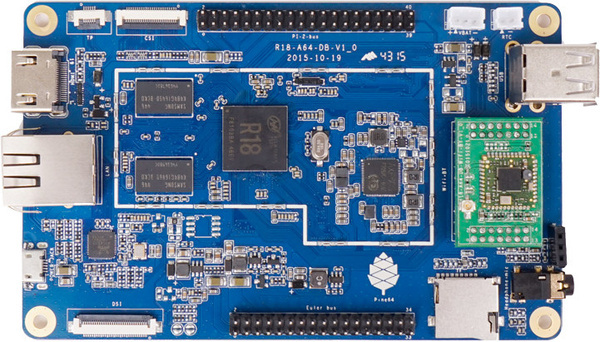

I like the hardware comparison.

Although I have no clue about the specifications about a B&C signing host, I dare say, this might just be good:

1 Like

i think the 1 GB RAM is a bit on the low side, maybe this is a better alternative

it has a 2 GB version, still waiting to receive one.

2 Likes

Lol, it is enough for settlement network(minting on blockchain), but I am not sure it can handle incomg 1000 request per second between B&C accounts. If it can, our signers pool with 500 signers can handle 50,000 tps(10 multi sig)with only hardware of 15,000$, and power consumption below 1500w, which are equal to only ONE 5T hash/s bitcoin asci minting rig.

I guess VISA/Bitcoin side chain will cry.

1 Like

Usdplus is interesting but only available on their nxt platform

Financisto, I cannot find the transaction ability per second of usdplus.

To sum up, VISA tps is 5,000 to 10,000.

Rootstock is 300-1000 tps.

Bitcoin is 3-7 tps.

Side chain (blockstream) is ?

PayPal is 100 tps?

YouTube click quantity per day is around 1 billion, i.e. 11500 click per second. If 10% of them are paid content. That’s 1150 transaction per second!

So the rootstock can only handle one big website(YouTube) with its full strength, VISA payment dare not provide instantly payment service to many websites because their process ability is poor compared with potential demand.

If we wanna rebell successfully against traditional bank or Bitcoin ecosystem, we must achieve 50,000 to 1 million tps, with our B&C account instant payment mechanism.

Btw, famous Chinese payment Alipay, declared its 85,900 tps in 11.11.2015. Let’s beat it in future!

Raspberry vs data center?

3 Likes

Correct the data,

Statistics show , Visa latest laboratory test data of 56,000 transactions / second , another global payment and settlement platform MasterCard laboratory test data of 40,000 transactions / second , in practice , the peak Visa processed 14,000 transactions /second.

Alipay said in 2015 during the two-eleven , Alipay actual processing capacity of 85,900 transactions / second, much higher than the actual Visa and MasterCard processing power , even higher than both have a large portion of laboratory data . This means that two-eleven exams through the payment system of China ,

4 Likes