Question: When do you think the next NuShare buyback is most likely to occur?

- less than one week from now

- between a week and a month from now

- between a month and four months from now

- between four months and twelve months from now

- more than a year from now

- NuShare buybacks will never happen again

0 voters

I thought it would be interesting and instructive to see how community opinion on this very important question has changed in the three months since the poll was initially presented. Back then, 56% of respondents said they thought NuShare buybacks would never occur again. To help inform people’s answers, let’s look at some facts about the financial state of Nu.

Tier 1 to 4 reserves are greater as a percentage of circulating currency than they have ever been at 34%. It used to be our policy to keep tier 1 to 4 reserves at 15%.

Liquidity operations has exhibited good expertise and keeping the peg has become a boring matter, being very stable and secure. Risks to the peg appear to primarily consist of default risks, particularly the risk that either @jooize or I will lose or steal a large quantity of funds. This appears unlikely.

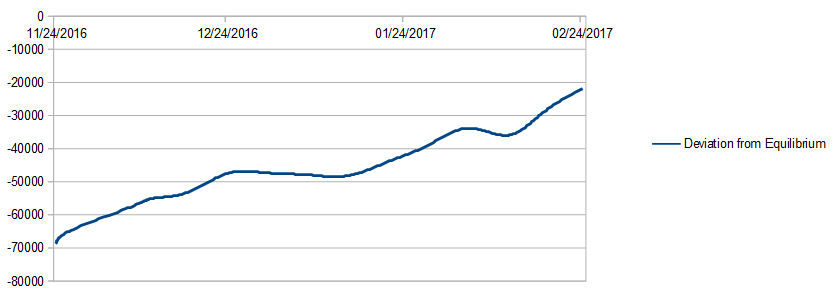

Our minimum reserve is currently $15,044 while we have $53,191 in tier 1 to 4 reserves. The distance between the two means many NuBits would have to exit circulation quickly to breach the minimum reserve. When the minimum reserve is breached, it results in an immediate NuShare sale that suppresses the NSR price and dilutes shareholders. It can be large if the amount of NuBits leaving circulation is large. From July until September, the minimum reserve was constantly breached, resulting in constant large NSR sales and dilutions. From September until December 8th, minimum reserve breaches occurred periodically, sometimes exceeding a 50% NSR dilution in just the space of a month. However, the minimum reserve has not been breached since December 8th, and a breach appears unlikely in the near future as we are approaching reserve equilibrium, as you can see from this chart of our Deviation from Reserve Equilibrium over the last three months:

The deviation is currently -$22,000, a major improvement in the level from three months ago when it was -$69,000. So long as the minimum reserve is not breached, we will only sell NSR in amount equal to 1% of the deviation each day, which is currently $220. The rate of NSR sales has declined very dramatically in recent months, which we can expect to have a profound influence on the NSR price. If the deviation extends the trend by reaching zero and then turning positive, we will have NSR buybacks instead of NSR sales, in proportion to the size of the deviation, which has no real upper limit.

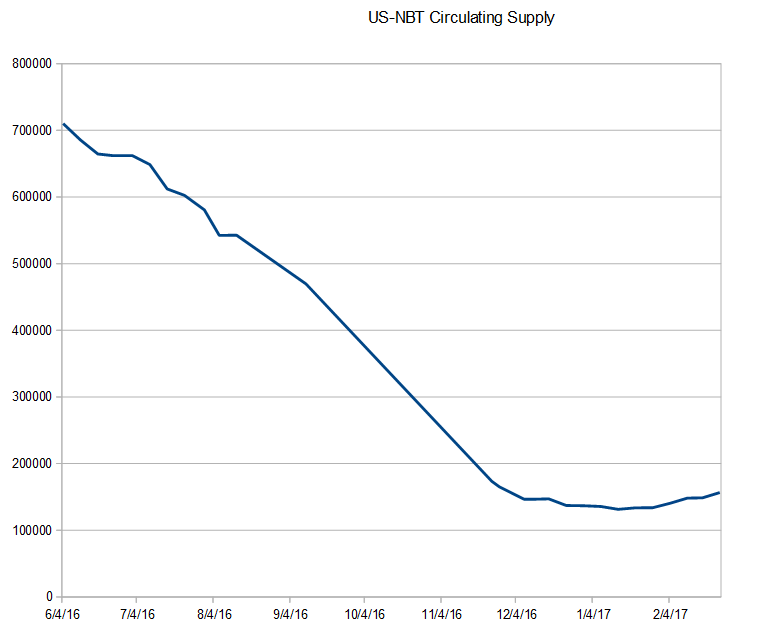

Another metric that gives us critical insight into the health of the network is the total currency supply data series:

After a steep and sustained decline due to the unnecessary, illegal and immoral Augeas default, you can see the money supply reached a plateau in early December. The delisting from the American based Poloniex exchange (announced December 19th, the day of the American election), eliminated most of our market for US-NBT, but the money supply only declined slightly in response. After reaching a low on January 14th, the total money supply has increased 19%. Merely maintaining this growth rate would lead to great success for Nu, but there is good reason to think an increase in the growth rate is quite possible, based on past growth rates.

While the NSR/BTC chart obscures the recent rise in NSR due to the rise of BTC, The NuShare price bottomed out on January 13th at $1.09 per voting block (10,000 NSR). Today the price is $1.83, a 68% increase from the bottom carved out more than a month ago.

In summary, network metrics paint a picture of rapid growth so far in 2017, after a period of stabilization at the end of 2016 following the Augeas rebellion against NuShare holders and NuLaw in May and June. Since the beginning of the year, we have seen a 15% rise in the circulating currency supply, a 54% reduction in the negative deviation from reserve equilibrium, and a 26% rise in the value of NSR, despite the unfortunate Poloniex delisting around January 5th. Finally, NSR liquidity is excellent at $1.2 million in the last month.