It’s the same thing as Nu with owners of makercoin instead of nsr holders as the ultimate reserve. The biggest difference, as always, is the power and history of our voting system as opposed to some advanced market automation. We have been growing in a more biological way while they pick a logic-driven method.

I think that is our strength, however when processes are becoming more established we should not forget to apply the logic to the software we are using in order to be able to compete and scale up when required.

New reddit discussion:

interesting: “We have also just updated our whitepaper again. It’s mostly cosmetic as well as changing all references to SDR rather than USD since that’s what we will peg to at first. Also contains the Dai logo.”

RIGHT – the SDR rather than the USD.

'The peg is maintained by adjusting the interest rate according to the Maker Price Feed which is an aggregate of all pricefeeds on Ethereum related to the Dai.

When a Dai issuer spends their newly issued Dai, they can only unlock the collateral by obtaining Dai again - or alternatively be the target of collateral redemption, which means someone else pays down their debt and buys a portion of the collateral, but at a price that is advantageous to the issuer. As an example if someone redeems your position that is at 150% collateralization, you make a 5% profit from the trade.’

https://forum.makerdao.com/t/nexus-report-shanghai-global-blockchain-summit/315

Wow, it seems like Nexus the company behind Maker the DAO that aims at creating a market stabilizer on Ethereum, took part to the last funding tour in china of Vitalik for Ethereum.

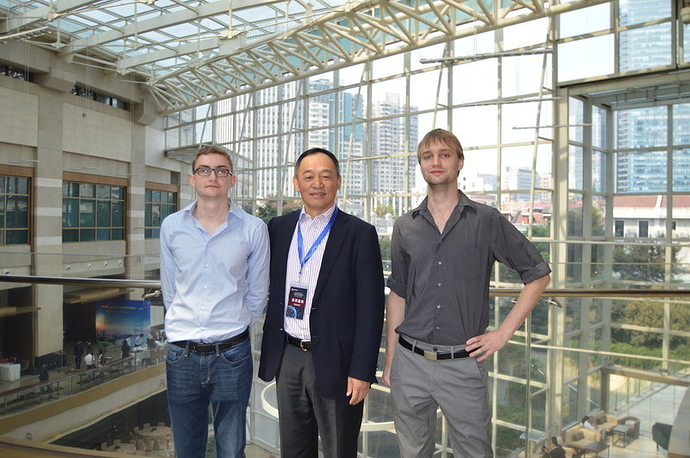

Photo of Mr. Xiao, the head of Wanxiangs 50M USD blockchain fund, Nikolai and me at the Hyatt

Photo of Mr. Xiao, the head of Wanxiangs 50M USD blockchain fund, Nikolai and me at the Hyatt

Photo of Gulu explaining the Dai’s mechanics at our meetup

Maker DAO has now given up on pegging on the USD, deeming it impossible.

“Another thing is that we’ve already given up on maintaining a 1:1 peg with any asset, as it’s not really possible unless the assets are fungible (or you use yield which is just a trick with numbers)- instead we target stable deflation with the SDR as the starting point. So it’s like a inflation targeting fiat currency but where we target slow and steady deflation, which we call deflationary yield (which takes over the role that explicit yield has in 0.2 of the DCS). Without a 1:1 peg the biggest advantage of using USD, it’s familiarity, disappears anyway - an example of this is bitUSD, the bitshares USD asset which trades above parity because it enforces full liquidity at 1 USD.”

But you “got” that :

Decentralized Capital (www.decentralizedcapital.com)

“US Dollar and Euro backed cryptoassets on the Ethereum blockchain”

Highly Suggested read -> http://ryepdx.com/2016/01/maker-dao/

Maker has a governance token called Makercoin (MKR) which is used for voting on proposals. Voting is weighted based on MKR holdings, which ensures those who are most heavily invested in Maker’s success also have the most say in what it chooses to do.

and

weekly buy-and-burns, in which Maker uses its profits to buy back MKR from MKR holders.

and

The CDP engine helps dai maintain its peg with the IMF‘s Special Drawing Rights.

Flattered by imitation …

The buy and burns are regular auctions rather than dual side. They copied what we were, not what we will become, the fools.

To be fair it’s copying both us and BTS. At some point they’re also realize liquidity doesn’t come for free, but it would be nice if there’s a competitor that we can learn from…

The explanation why they peg to the SDR is a good read. I like it, because it fits my vision of the Nu network.

But in my opinion they have chosen a questionable design of the peg.

My knowledge about financial policy is limited, but in my opinion designing a deflational currency has two significant drawbacks:

- it’s not stable (that would be true for inflational currencies as well)

- there’s an incentive for keeping the money instead of spending it for it will be worth more tomorrow than it is today and you can pay for more goods and services with it, if you spend later

It’s bad enough, if a currency has to face deflation from time to time.

But it’s totally important what the reasons are; deflation is not necessarily bad.

In the case of the Dai my assessment is: flawed by design.

The success of DAI will depend on the deflation to be small enough.

Trying to peg only to SDR exposure and not to SDR itself is the inferior choice to pegging to SDR directly.

It’s a step into the right direction.

Nu already is (regarding the X-NBT design) a step ahead of DAO.

Nu can offer X-NBT with a track record of providing stable products and 1 X-NBT will, in difference to the Dai, be worth 1 SDR - today, tomorrow, next year.

No need for the customers to calculate!

The Dai is better suited for storing value than for being used as currency.

Dai seems to work more like a “bond” based on SDR than a stable cryptocurrency.

And I found another flaw that is related to

If you really can predict the rate, you can speculate on future interest.

That causes the volatility of the Dai to be bigger than the volatility of the SDR.

If I know, that I can have, say 10% interest annually (the number is intentionally high, not knowing whether it’s realistic, to make the point more clear), people will buy Dai for an uplift of 6%, if other comparable investments offer less than 4% annually.

The next change of key interest rate of one of the currencies, which is in the SDR basket, will show what I mean - assuming that the Dai will have some acceptance, which I doubt.

That effect can only be limited, if the annual deflation is very low.

The success of the Dai might be tied to the percentage of the annual inflation.

If my assessment is right, it’s a bad choice to introduce predictable deflation, especially it turns out to be a high one.

I was re-reading rune (makerdao leader) reddit post trying to convince ethereum guys that nubits peg break cannot happen on makerdao –

One guy asked the interesting question – how smart contracts will basically prevent the break by being cryptography-enforced AI , supposedly replacing failable humans like in Nu.

His reactions says it all to the chance of success of makerdao, as a business venture…