whitepaper:

http://makerdao.com/Makerpitch02.pdf

Who pay the interest?

"Issuers must pay an interest rate on their debt, that varies daily depending on the status of the peg.

● The interest rate is manipulated to enforce the peg in the long run. If the independent price feeds determine that EUSD is valued above the peg, the interest rate decreases by 1 percent. If the independent price feeds determine that EUSD is valued below the peg, the interest rate increases by 1 percent. If the peg is holding, the governors can choose to modify the interest rate with up to 0.5 percent in either direction. This adjustment happens every 24 hours."

What’s the incentive to become an eDollar issuer since she/he will pay money?

Their forum discusses nubits and compares it with edollar and bitusd here: http://forum.makerdao.com/t/difference-between-edollar-vs-nubits-bitusd/37

Studying their attempt to a stable currency allows one to see Nu’s elegance.

Their forum: link

Their peg unit: dai link2

Their marketing strategy: link

Market incentive to keep the peg: link

Dai white paper simplified

“Dai cannot appear out of thin air, they need a form of collateral to back their value.

Each dai that is created needs to be backed up by an asset with at least 150% of its value. An asset could be BTC, Ether, gold, etc.

For example to create dai with BTC worth $150, the BTC will be locked and 100 dai ($100) will be created.

Why at least 150%? The value of BTC can go up and down, there is a risk that the dai will not have enough collateral to keep its value.”

“Do we have any estimate on the likely release date for the dai? Is the plan still to wait until the SDR basket is reevaluated in October before deciding whether the dai will be pegged to USD or SDR?”

It’s the same thing as Nu with owners of makercoin instead of nsr holders as the ultimate reserve. The biggest difference, as always, is the power and history of our voting system as opposed to some advanced market automation. We have been growing in a more biological way while they pick a logic-driven method.

I think that is our strength, however when processes are becoming more established we should not forget to apply the logic to the software we are using in order to be able to compete and scale up when required.

New reddit discussion:

interesting: “We have also just updated our whitepaper again. It’s mostly cosmetic as well as changing all references to SDR rather than USD since that’s what we will peg to at first. Also contains the Dai logo.”

RIGHT – the SDR rather than the USD.

'The peg is maintained by adjusting the interest rate according to the Maker Price Feed which is an aggregate of all pricefeeds on Ethereum related to the Dai.

When a Dai issuer spends their newly issued Dai, they can only unlock the collateral by obtaining Dai again - or alternatively be the target of collateral redemption, which means someone else pays down their debt and buys a portion of the collateral, but at a price that is advantageous to the issuer. As an example if someone redeems your position that is at 150% collateralization, you make a 5% profit from the trade.’

https://forum.makerdao.com/t/nexus-report-shanghai-global-blockchain-summit/315

Wow, it seems like Nexus the company behind Maker the DAO that aims at creating a market stabilizer on Ethereum, took part to the last funding tour in china of Vitalik for Ethereum.

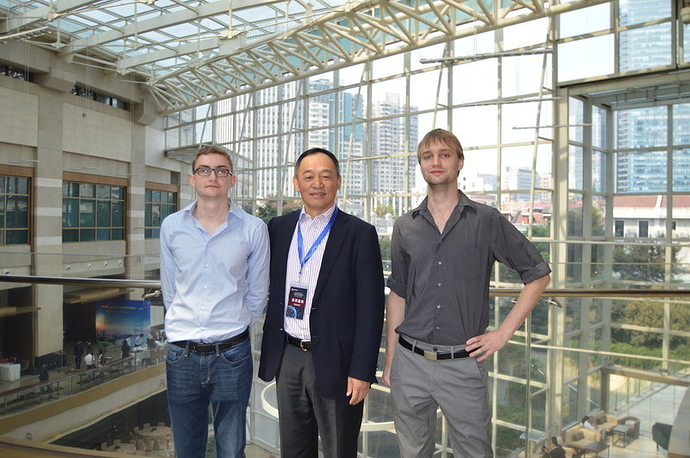

Photo of Mr. Xiao, the head of Wanxiangs 50M USD blockchain fund, Nikolai and me at the Hyatt

Photo of Mr. Xiao, the head of Wanxiangs 50M USD blockchain fund, Nikolai and me at the Hyatt

Photo of Gulu explaining the Dai’s mechanics at our meetup

Maker DAO has now given up on pegging on the USD, deeming it impossible.

“Another thing is that we’ve already given up on maintaining a 1:1 peg with any asset, as it’s not really possible unless the assets are fungible (or you use yield which is just a trick with numbers)- instead we target stable deflation with the SDR as the starting point. So it’s like a inflation targeting fiat currency but where we target slow and steady deflation, which we call deflationary yield (which takes over the role that explicit yield has in 0.2 of the DCS). Without a 1:1 peg the biggest advantage of using USD, it’s familiarity, disappears anyway - an example of this is bitUSD, the bitshares USD asset which trades above parity because it enforces full liquidity at 1 USD.”

But you “got” that :

Decentralized Capital (www.decentralizedcapital.com)

“US Dollar and Euro backed cryptoassets on the Ethereum blockchain”