REDUCING SETTLEMENT LATENCY AND COUNTERPARTY RISK

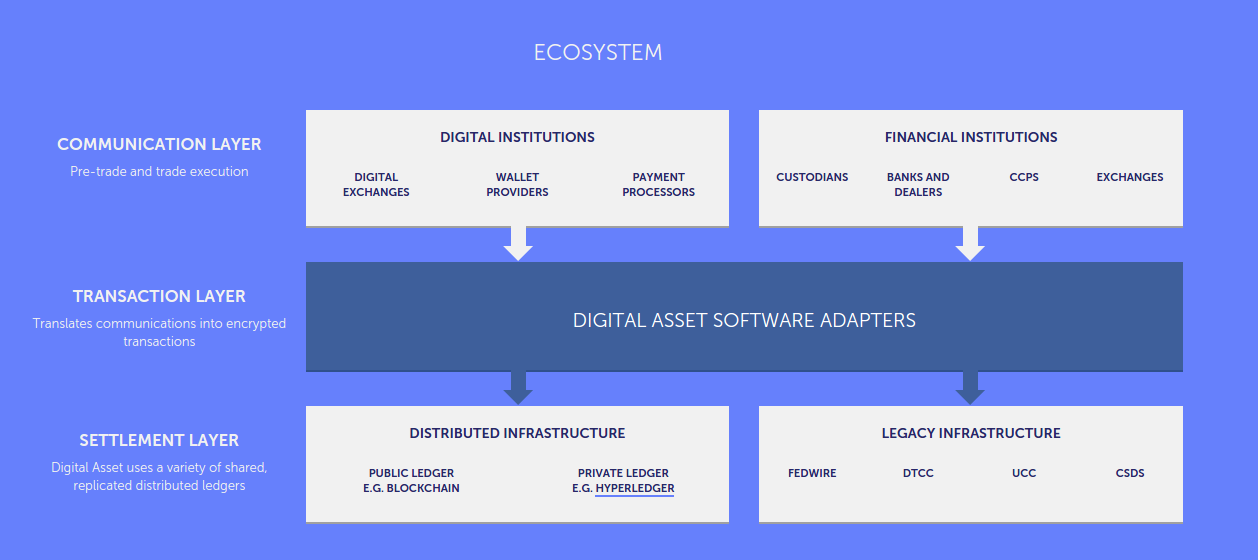

Digital Asset brings 21st century technology to existing financial infrastructure. We develop technology that aids efficiency, transparency, compliance and settlement speed using cryptographic, distributed ledgers.

WHAT IS A BLOCKCHAIN OR DISTRIBUTED LEDGER?

A blockchain is an append-only database of transactions which has two key elements: 1) a shared, replicated ledger, and 2) a distributed database synchronizing mechanism known as a “consensus algorithm”. In a blockchain, each transaction must reference a balance received from a previous transaction and must be cryptographically signed by the provable owner of the balance. The linked transactions form an exact chain of title over time. A blockchain is just one type of distributed ledger, not all distributed ledgers necessarily employ blocks or chain transactions.

WHAT IS A CONSENSUS ALGORITHM?

A consensus algorithm is a set of operations by which a distributed system reaches agreement. In most distributed consensus systems, some entity must propose a ‘commitment’ of a new transaction. Some mechanisms, like the Bitcoin blockchain, expend resources in order to win the right to commit transactions (Proof-of-work, ‘PoW’). Others, like Hyperledger, predetermine a primary rotation for the entities that will order transactions and closely monitor behavior for erroneous or malicious activity (Practical Byzantine Fault Tolerance, ‘PBFT’).

WHY SHOULD I CONSIDER A DISTRIBUTED LEDGER?

Today’s financial transaction recording and settlement systems require the duplication and distribution of enormous amounts of data. In many cases, incongruencies within and across these systems create inconsistent transaction data that often necessitate costly reconciliation processes.

A distributed ledger is exactly replicated and synchronized across many different entities in order to add an increased level of resiliency and data integrity. If one or many locations that hold a copy of the distributed ledger are attacked or somehow fail, the remaining locations are able to maintain the ledger in their absence.

By sharing and replicating information, distributed ledgers allow for real-time information, reduced error or “fail” rates, and tremendously reduced costs from building shared infrastructure. Furthermore, distributed ledger technology enables the opportunity for economies of scale achieved by allowing the transaction to serve simultaneously as agreement, settlement, and regulatory reporting. Instead of building countless duplicative and redundant services, one master prime record can serve as the source, eliminating the need for reconciliation and increased post-trade processing speed.

Source: http://digitalasset.com/faqs.html

It sounds like they use the blockchain tech to replicate data uncompromisingly – but why the blockchain for that end?