what do the above lines mean?

A single order has a size of 500 (I don’t know why,

but succeeding order sizes tend to increase…).

The first order has an offset of 0.0035 or 0.35% making it an “offset after fees” of 0.6% for the buyer, if the order is on the order book and gets bought (Nu on maker side, customer on taker side).

It’s an “offset after fees” of 0.5% for the customer, if NuBot places the order into an existing buyside order (not that likely at the moment).

Each succeeding order has an offset increment of 0.001 or 0.1% on top of the preceding order.

Did you mean 0.6% ?

No, if we (NuBot) buy into an order of the customer, the customer is the maker and pays only 0.15% fee at Poloniex, while the taker (NuBot in that case) has a fee of 0.25%.

@FLOT, @cryptog, @Dhume, @dysconnect, @jooize, @mhps, @ttutdxh, @woodstockmerkle,

the first NSR were sold for BTC:

I suggest we continue the discussion on this matter:

As soon as the NSR are traded, there are funds, which can be used to try reviving the liquidity provision. The BTC are already at one of my Poloniex NuBot gateway accounts. I can’t use NuBot on that account until the sale is complete, because NuBot deletes the NSR orders when shifting walls.

The alternative is to withdraw it to FLOT reserve.

I’m in favour of trying to get the liquidity provision going.

What do you say?

Before I forget, I suggest we reserve 10 btc and authorize a custodian to place them at e.g. $0.1 in case of a bank run or an attack described here (step 3). If someone wants to sell cheap nubits, we want them to fall in our hands. Proceeds Nubits are outstanding nubits and will be burned.

There are about 3.5btc on the buyside above $0.1 but below 5% spread. Placing a sizeable order at $0.1 encourages smaller bargain hunters to front run this order therefore putting more buys above it.

Whenever the volatility is low we should lower the spread. Volatility in the last 4 days have been low relatively. Your proposal is fine.

Thank you. Let’s wait for some more sentiments.

Another great idea!

Would a FLOT member be willing to step up and do that?

It wouldbe good to split responsibilities a little bit.

All that’s required is a Poloniex account.

@FLOT, @cryptog, @Dhume, @dysconnect, @jooize, @ttutdxh, @woodstockmerkle

by joining in an existing pool and setting a huge offset?

If you are at that big offset, you don’t even need NuBot and can place orders manually.

Whether it’s 90% offset or 85% or 92% doesn’t really matter.

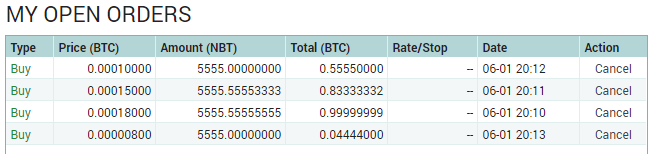

Until someone is found, I put the proceeds from the NSR sale on order at the NBT/BTC pair:

That does no harm, unless BTC drops to $5 - in that case we have other problems, but it’s not very bad, because we barely have BTC left ![]()

The “best” buy is at $0.095 at the current BTC rate ($533).

5555 NBT @ 0.00018000 BTC; total BTC: 0.99999999

5555 NBT @ 0.00015000 BTC; total BTC: 0.83333332

5555 NBT @ 0.00010000 BTC; total BTC: 0.55550000

5555 NBT @ 0.00000800 BTC; total BTC: 0.04444000

I would be in favor of putting half of the proceeds on NuLagoon and half of the proceeds to BTC FLOT.[quote=“masterOfDisaster, post:1830, topic:1239”]

Another great idea!Would a FLOT member be willing to step up and do that?It wouldbe good to split responsibilities a little bit.All that’s required is a Poloniex account.

@FLOT

[/quote]

Cannot do that unfortunately.

which comment ?

The one in his motion regarding liquidity.

The super tight spread at NuLagoon is the last thing we need now and the reserve still has 31 BTC.

There are more important things to do with the proceeds from the sale.

To get the liquidity provision going, testing the offsets at which real trading starts without seeing the BTC just evaporate is useful.

I agree, but am uncertain of methods to do it. Which alternatives do we have?

- Putting BTC on tight spread.

- Putting BTC on degraded (broken?) peg spread.

- Motivating liquidity provision?

- …

FLOT has 31.7 BTC. Plus 6.9 BTC so far from NuShare sale. Expecting 8–20 BTC to arrive from CCEDK.

How do we replenish our Bitcoin liquidity reserve?

- NuBit sales.

- NuShare sales.

- …

I have to decline putting those 10 BTC at $0.1 myself, unfortunately.

I’m also in favor of not putting up 10 BTC at 0.10$ cents a piece. Its an interesting idea but we dont have funds to experiment with right now.

B&C Exchange currently has exactly 4 BTC. It is in the interest of B&C Exchange to trade these for NuBits. @masterOfDisaster can we arrange an off exchange trade by PM please?

You mean sending the 4 BTC FLOT and receiving NBT from FLOT in exchange for them?

I could send the BTC to FLOT and transfer the NBT from shareholder funds under my control if you like. Just wasn’t sure if you wanted the funds on your gateway instead. Whatever you choose.