Creating market awareness is important to allow economic operation of liquidity provision.

It’s good to start working on a mathematical model.

I know already that market awareness will provoke opposition, but I’m damn sure that liquidity provision doesn’t work reliably without it (we see it at the moment):

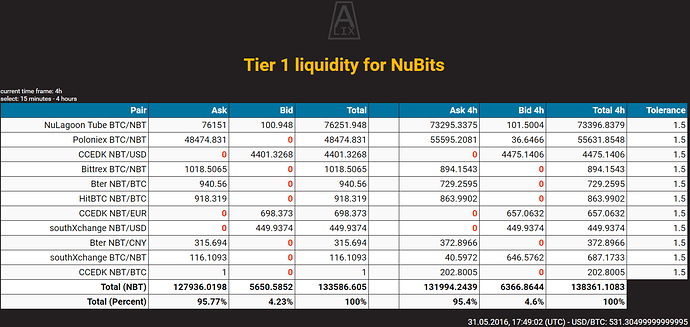

- you either run out of funds trying to support liquidity provision with high volume at a tight spread not caring about environmental parameters

- or you run out of liquidity provision at all

What we can derive from the current emergency situation and the gateways at a high buyside offset is:

- even at 5% offset trades happen

- quite some trades happen with orders that aren’t provided by the gateways - this could be

- regular traders

- ALP funds

In fact there’s a kind of market awareness, albeit not as a formula, that made the offset of the gateways that big:

the BTC bull market created an immense demand for BTC. The supply of BTC in Nu reserve is limited and so the price had to increase.

As long as there’s no sign of the bull market being over, there’s no reason to reduce the offset. Doing it would just empty the reserves, leaving totally no peg support left.

The fate of the peg would be in the hands of traders.

That doesn’t sound much like a pegged currency.

A buyside peg to $0.95 is better than no peg!

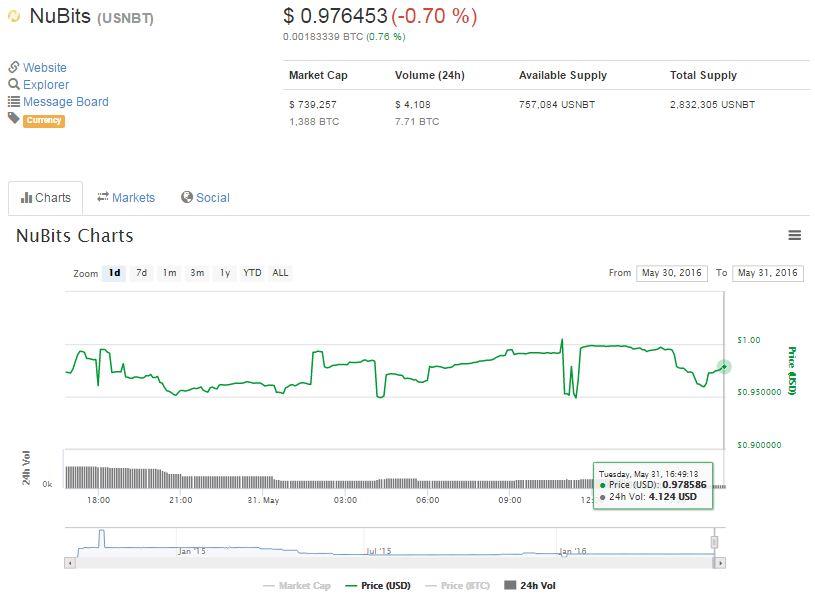

The sellside is pegged to $1.005 btw.

If the spread would be adjusted by formulas like those proposed by @mhps, the trade volume would suffer from it.

We see less trade volume at Poloniex now for several reasons.

One is that BTC is less volatile and not surging (or nosediving) at the moment. Another one is the offset.

With market awareness, spreads would increase (and decrease) as a function of traded volume, volatility or other parameters.

Seeing less trade volume doesn’t sound attractive.

Having a much more reliable and even cheaper liquidity provision is the benefit of it.

With properly adjusted market aware parameters, there would be no need for gateways (I’d like to keep them as backup - just in case…).

But that means, that depending on the situation, even ALP need to operate far outside 1% spread.

And why not?

If you can’t guarantee a small spread for as long as you wish (forever?), it’s better to increase the spread, if that helps you sustaining liquidity provision at all.