58 posts were split to a new topic: Experiment of Trading Volume at Different Spreads Using a Gateway

I’ll disable CCEDK on ALix on June 1rst.

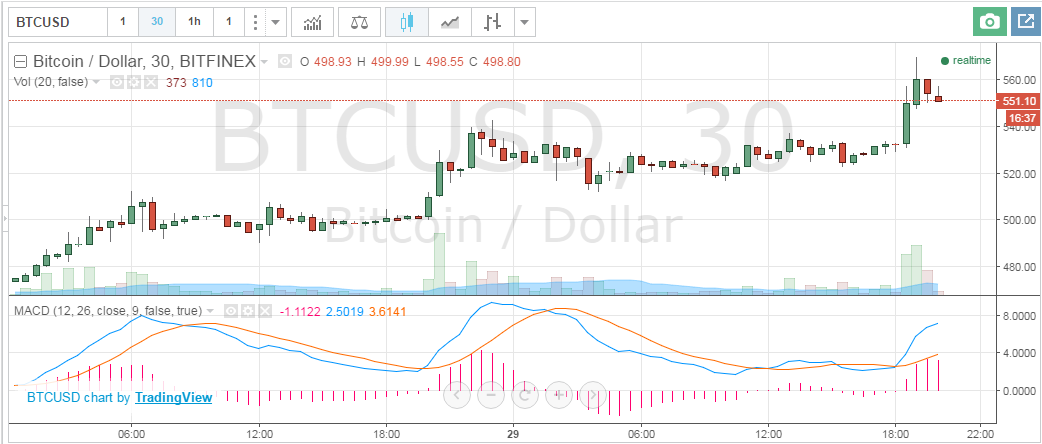

Another surge in BTC/USD:

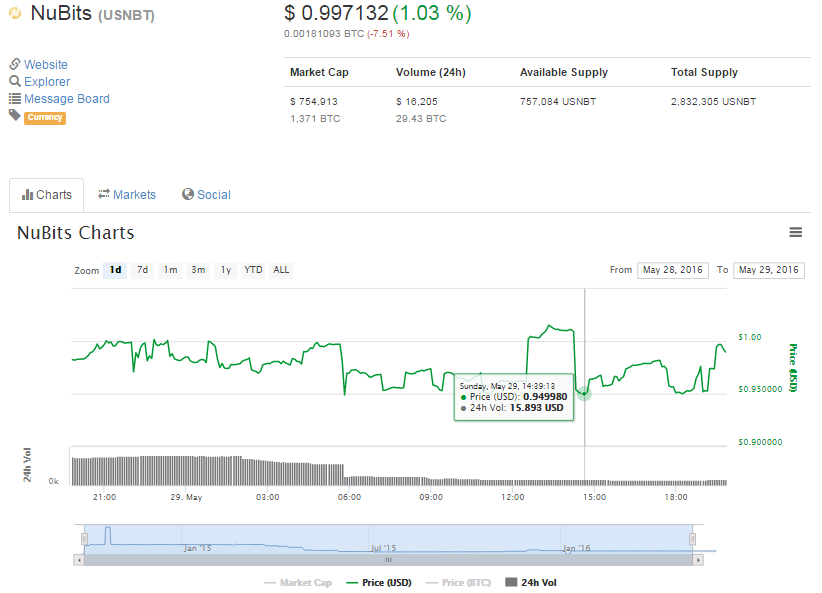

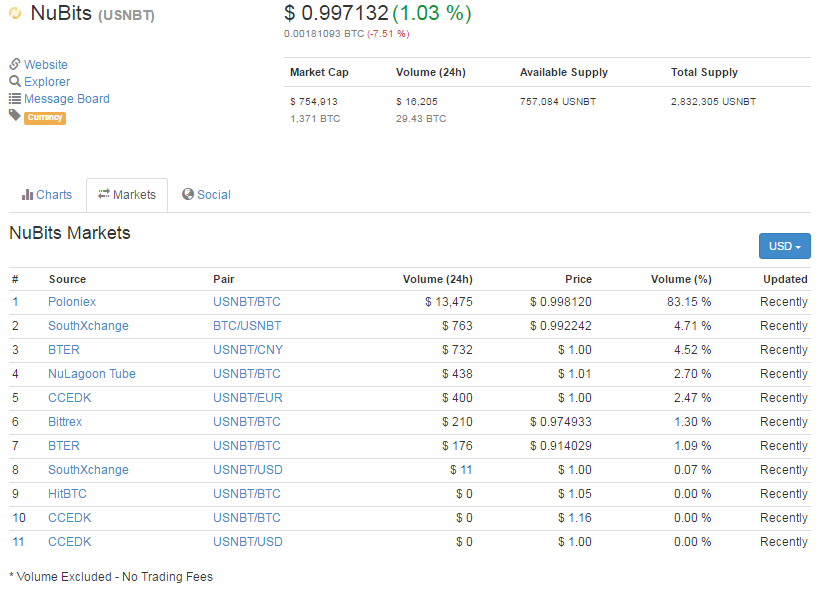

The peg is not exactly what we’d consider in perfect order - at least not in normal times:

The trade volume has taken hits from the reduced liquidity:

Wanna know why the peg at Poloniex didn’t fail completely? The NuBots @zoro and I operate are creating a demarcation point at 5% offset (zoro’s) and 6% (mine).

As long as zoro’s NuBot has funds on buy side left, the NBT/USD rate measured via synthetic NBT/BTC peg won’t drop below $0.95 and as long as my NuBot has funds on buy side left, the peg won’t drop below $0.94.

There are still funds on buy side! They get consumed only slowly. The offset is not very attractive - just like it’s meant to be:

Sun May 29 20:13:08 UTC 2016

status of mOD dual side NuBot at Poloniex:

nud getliquidityinfo B | grep B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt -A 2

"B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt" : {

"buy" : 9170.72,

"sell" : 3409.3515

status of zoro dual side NuBot at Poloniex:

nud getliquidityinfo B | grep BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo -A 2

"BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo" : {

"buy" : 7931.8,

"sell" : 22634.1522Over the course of the last hours some BTC were sold, the sell side of both zoro’s and my NuBot report an increasing sell side volume. But that’s only small amounts.

This is the prime reason, why I drafted this proposal:

@JordanLee’s proposal

is no fit for supporting NBT/BTC. It would be good for NBT/USD.

I’d like to be in a world, where it can be sustained for NBT/BTC as well.

Alas, we aren’t and it can’t in the near future. Nu needs to make a lot of (final!) revenue to sustain such a model.

It’s not possible now.

And @Cybnate’s proposal

although partially moving in the right direction doesn’t go far enough.

Consider the current situation.

Think what would have happened, if we didn’t act according to my proposal.

Imagine what would have happened to the buy side when limited to max spreads/offsets as stated by @JordanLee or @Cybnate.

@JordanLee, do you still think your proposal is the way to go?

What is your conclusion about the current situation and how we treat it?

Would you have preferred having sustained a perfect peg for another hour and complete helplessness thereafter, or can you agree that it’s better to have a demarcation point at $0.95 that seems sustainable for an extended period of time?

This is the best we can do for now unfortunely, its a byproduct of pegging BTC/NBT instead of USD/NBT. We do have a decent ammount of funds in multisig now though so we need to keep an close eye we keep the bots filled to maintain the “weak” peg.

Technically you don’t know what would have happened. At some stage the amount of NBT in the hands of traders would be empty. Unfortunately we don’t have a lot of data on how much NBT is held on exchanges. Also unexpected was 1 trader selling of a huge amount at once a scenario we stupidly didn’t prepare for.

I think spreads should exceed 2.5% when reserves are still available. When they run out unexpectedly we see a crises. With a real crises anything should be possible to save the peg. With running out of BTC available to support the peg we should have gone into grinding the network to a halt. I’m glad we choose to support a weak peg instead.

However, I believe some work needs to be done regarding the reserves and managing liquidity, not on changing motions for spreads during crises.

Sure - and raising awareness for flaws of proposals when those flaws are apparent is not welcome?

I agree, we don’t know, but we can make an educated guess. Educated guesses is what lead to the creation of the gateways in the first place and the parameters were determined based on educated guesses and experience.

Are you in favour of getting data this way?

You still don’t trust my experience. Understood.

As I said we are in a crises without timely and adequate BTC / reserves. So not a good idea to test now probably.

I just tried to say that we should separate out the way we behave during a crises and how when we have adequate reserves to support the peg.[quote=“masterOfDisaster, post:1783, topic:1239”]

You still don’t trust my experience. Understood.

[/quote]

I get you are not happy, but that is not what I’m saying.

NuBot gateways at a rather high buyside offset and rather small sellside offset are well-funded now:

Mon May 30 15:19:07 UTC 2016

status of mOD dual side NuBot at Poloniex:

nud getliquidityinfo B | grep B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt -A 2

"B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt" : {

"buy" : 12210.8,

"sell" : 20161.9209

status of zoro dual side NuBot at Poloniex:

nud getliquidityinfo B | grep BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo -A 2

"BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo" : {

"buy" : 11992.54,

"sell" : 18692.922This is a lot of money that could get lost by exchange default.

I’m aware of that.

Everyone should be aware of that.

Yet I don’t see an alternative that is sufficiently reliable.

I don’t have numbers at hand regarding the exco.in and bter losses, but the debt at ccedk from the February 2015 losses alone is above 30k.

Compared to those losses, the money at stake is in a similar order of magnitude.

Without it, there’d be no reliable peg support, although it’s on a degraded level.

The demarcation point of $0.95 could be kept so far.

In my opinion the value for the brand image is far superior to the funds at stake.

If NBT were to drop to $0.50 (no one knows whether that would happen, but we know that $0.95 is the limit as long as BTC in zoro’s gateway remain and $0.925 as long as my gateway has BTC left), the effect on the total value of Nu would likely be far above $60k.

The drop to $0.95 already cost hundreds of thousands of USD in corporate value.

The $60k is peanuts compared to it.

Plus they are not lost - they are just at stake!

Water level of the gateways at Poloniex

Tue May 31 05:48:51 UTC 2016

status of mOD dual side NuBot at Poloniex:

nud getliquidityinfo B | grep B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt -A 2

"B9gXptkoqAApF3AFrQyhUbhSzvuEudxupt" : {

"buy" : 12168.61,

"sell" : 20161.9209

status of zoro dual side NuBot at Poloniex:

nud getliquidityinfo B | grep BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo -A 2

"BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo" : {

"buy" : 10567.2,

"sell" : 20167.7629@zoro has traded BTC and received 1,500 NBT. One of the orders at 5% offset was completely traded as it seems.

Selling NBT by NuBots doesn’t happen, although the offset on sell side is small in both @zoro’s and my NuBot settings.

Maybe we have another issue with the price feed.

I’ll have an eye on the Bittrex BTCUSD rate compared to the Poloniex rate.

Would you record your profit? I guess u may self-funded with 5% spread. This is the best chance to experiment your spread theory, without any “obstruction”.

I plan on making a calculation for a NAV at the begin of the operation and the end of it - once my gateway gets put on standby again.

I try to prove one of my claims that with a considerable spread, you can compensate at least some, maybe most of the costs that are associated with using Nu funds for gateways.

Btw. - the spread of my operation is roughly 8%, asymmetrically divided in 7.5% buyside and 0.5% sellside.

That’s why I rarely see trades on buyside. I’m the second line of peg defence after @zoro.

A kind of parametric order book, if you want to call it so.

Do you all realize how calm the situation is thanks to the gateways at increased spread?

Can you imagine how it’d be without them?

Without the gateways, all you had left to give customers asking for liquidity

was a shrug.

I wouldn’t boast this as a positive. As NuBits holder I’m basically held to ransom, hoping that the peg returns within normal boundaries anytime soon. Best part is that it didn’t go much beyond the 10% spread. BTC price is still rising though, and NuShares sales appear to be inadequate to recover to a normal peg. What is the next step besides hoping BTC turns around?

Then I suggest you join FLOT and operate gateways that you try to keep balanced or even funded on each side at a closer spread.

It’s indeed positive as we do the best we can considering the circumstances.

The peg didn’t fail completely. It’s just on degraded quality.

You can sell at an uplift of 5% now.

We are in fact within a 5.5% spread, because the offset is 5% on buyside and 0.5% on sellside.

Do you have a suggestion to improve the liquidity situation without risking the peg we still keep?

Keeping the peg was only on that level was only possible, because we increased the buyside offset.

To revive the liquidity provision it would make sense to close the spread with ALP, by letting them start liquidity provision at a buyside offset of say 3% and letting them tighten the offset until the trade volume is on the level you want to have while still being able to support both sides.

Jumping in at 0.5% offset is not the best idea. Testing the waters, reducing the offset in steps would be a way to recover.

Some people are ready to buy even at large spreads…[quote=“masterOfDisaster, post:1788, topic:1239”]

Btw. - the spread of my operation is roughly 8%, asymmetrically divided in 7.5% buyside and 0.5% sellside.

[/quote]

I am very curious to know empirically about the minimum spread that makes gateways self-funding possible, meaning that we would not need to use the funds of Nu at gateways while at the same time pay the operators fees.

In other words, what spreads can counterbalance purely the cost (risk of exchange default)?

The cost also depends on pair volatility, on same exchange, the NBT/USD liquidity cost is lower than NBT/BTC.

I am talking about nbt/btc.

This spread will depend on a lot of factors like exchange default risk, BTC volatility, etc.

Market awareness is necessary to adjust the spread properly.

At the moment we do that based on guesses and experience - quite well, if you ask me.

Under normal circumstances you won’t have trades at a spread, which can compensate the costs, because ALP cuts you off your trades.

This is only working during emergencies, or if you allow a big spread for ALP.

Most won’t find that desirable. I think it should be discussed nevertheless.

The bigger the spread, the more gain from trades, but the less number of trades you make.

Each market condition will have a sweet spot, which maximizes the revenue per time frame by having a maximum of

tradevolume * revenue per trade.

Finding that optimum is the challenge.

You can still buy USD at CCEDK with 1% spread after fee. In fact I just see $4,300 USD available. You might have to withdraw USD (for example to buy BTC elsewhere), but at least the spread is low.

Don’t you wish we had deep liquidity on NBT/USD if only for risk mitigation purposes in situations like now? We used to have like $7,000 on each side until the target and reward were slashed. NBT/USD liquidity is foundamental in Nu’s system.

This puts the situation in a nutshell.

All trouble we currently have to face originates from a synthetic peg.