The grant is ready for voting:

BD8ork1pAt3vuVgGaX7j9Ei66xT3vvqrg2 , 1 NBT

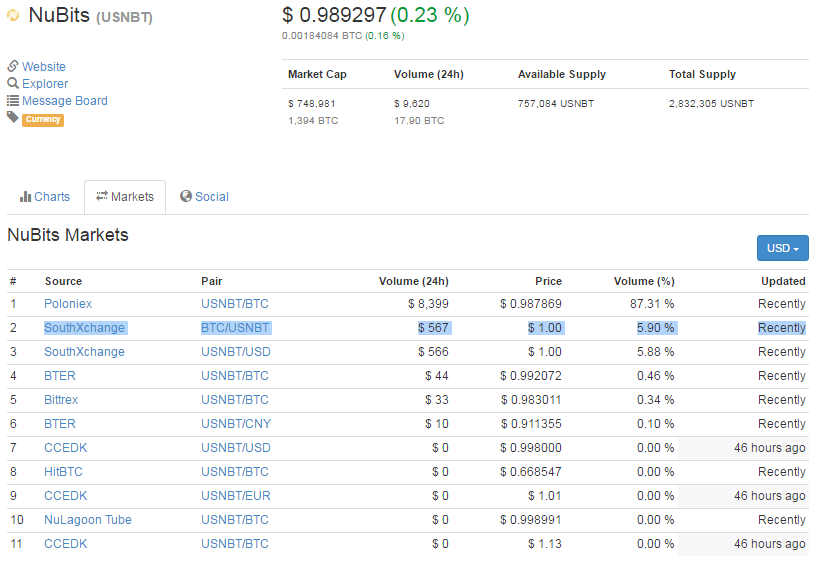

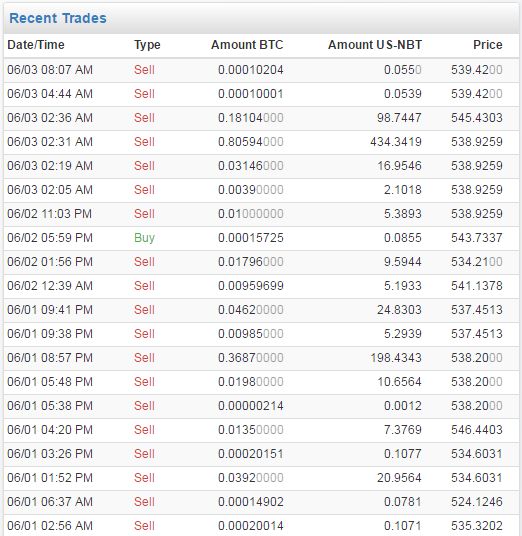

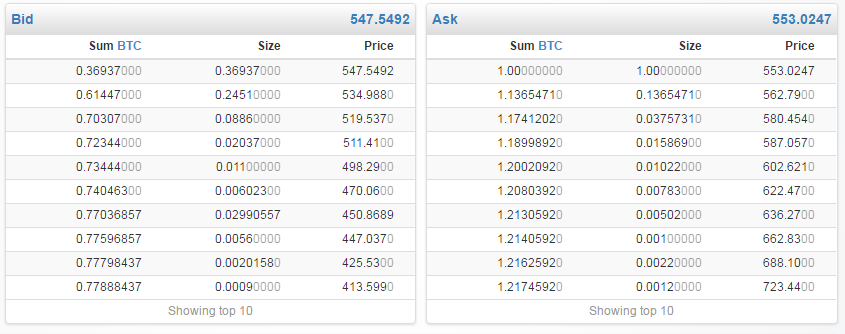

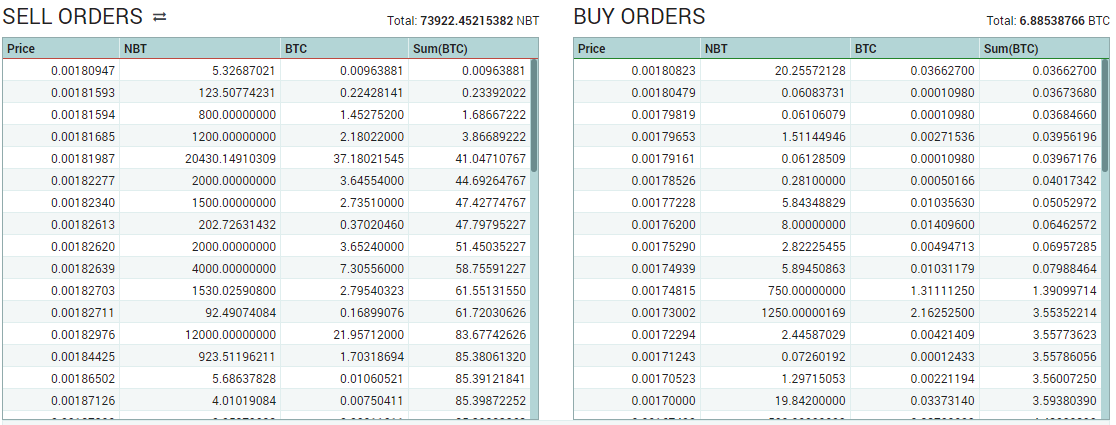

After successfully testing nubot 0.4.1 RC2, i am confident to propose a sell gateway nubot in southXchange’s BTC/NBT pair.

I would like to propose also a bot in NBT/USD pair but firstly i have to check how i can handle the fiat

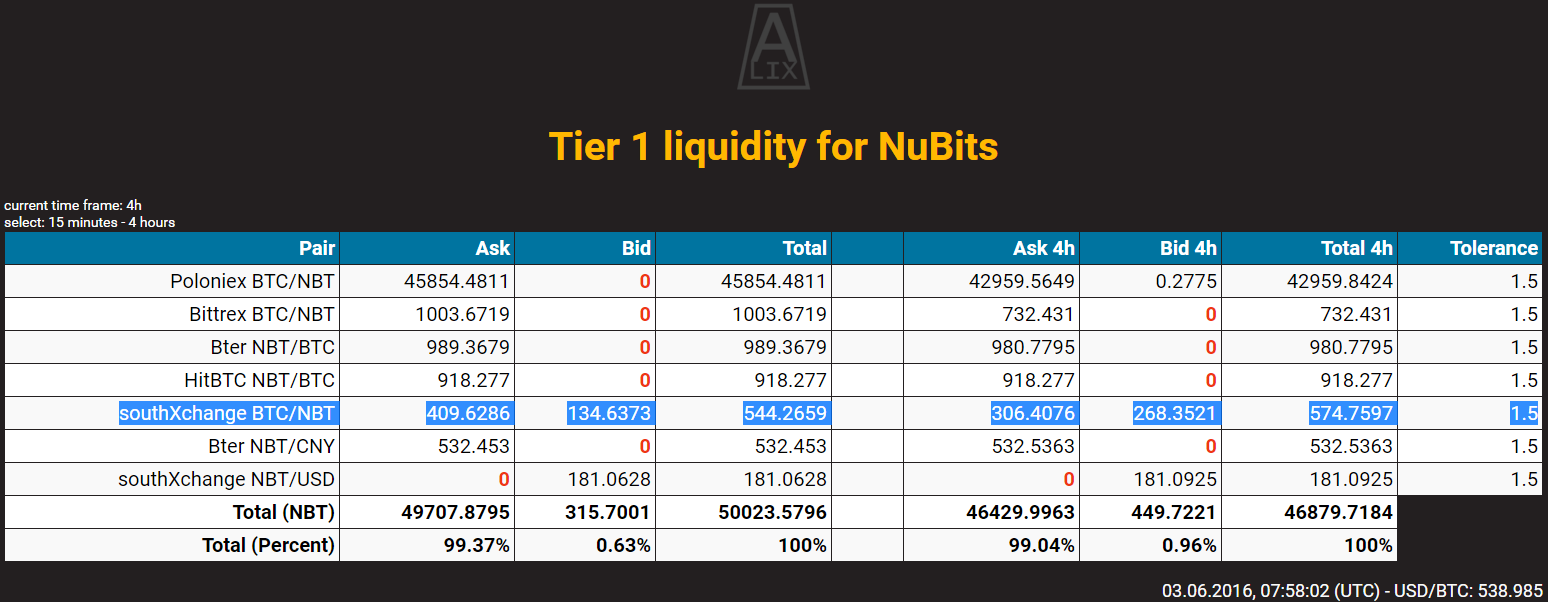

The gateway can be used by any T4 party, FLOT or JL

with any NBT amount they see fit.

Motion RIPEMD160 hash: aee58fd4fd6a664a3cf509d96877b8b18dd9b789

=##=##=##=##=##=## Motion hash starts with this line ##=##=##=##=##=##=

Custodial Grant address:

BD8ork1pAt3vuVgGaX7j9Ei66xT3vvqrg2 , 1 NBT

SouthXchange NBT Entry GatewayIntro@zoro - below called “the operator” - will run a single sided NuBot on SouthXchange.The liquidity is being broadcast using a custodial address to allow tracking the liquidity situation of the bot. This custodial address will only be used for broadcasting liquidity of this operation.The operator promises to send all funds to a FLOT multisig address upon request of a majority of the FLOT members or by a passed NSR holder motion.

The nubot will operate with an offset of at least 1%. Nubot’s configuration parameters are to be communicated with FLOT following the appropriate liquidity strategy that is decided.

Availability: The operator offers to check for NuBot’s operation on a daily bases. This translates in a response time of at least 24 hours worst case.

Begin of operation: Operation begins on the day NuBot puts the first NBT deposit of funds by FLOT on the SouthXchange order book

End of operation: Operation is ceased by request of withdrawal of all funds or if operator sends all funds to FLOT multisig address(es). The remaining grant fees will be burned or send to a FLOT’s NBT address. If for any reason the operator has to stop NuBot for a period of time or permanently before the end of the contract, it will be communicated at least 7 days in advance.

Modes of withdrawal:NSR holders can request withdrawal by motion.FLOT members can request withdrawal to a FLOT multisig address for which they are signer by posting in the forum.The number of FLOT members to request a deposit to a FLOT multisig address equals the number of FLOT members to execute transactions from this address.Once a week the operator will withdraw all BTC to a FLOT multisig address,usually during weekends.

Compensation: The operator charges 50 NBT for 30 days of operation. To be paid at the end of the period.

Reasoning for compensation:NuBot will be running on a private windows server. The compensation is mainly for the weekly manual withdrawals and general monitoring of operations.

Premature activation:If the FLOT deposits funds at the operator’s exchange account, they will be used by the operator as if this motion already passed.

=##=##=##=##=##=## Motion hash ends with this line ##=##=##=##=##=##=