I want to open this topic to collect thoughts on basket of currencies and basket of goods.

It is my opinion that if (and only if) we want to release a product that has as a main focus the price “stability” and truly trans-national currency of exchange , then an engineered index that takes into account different currencies is far superior than any other national currency.

On the other hand, if we want to achieve other marketing or strategic purposes different from “stability” (attract Chinese community, etc… ) this might not be the best choice.

What is stability?

For a currency, stability can be summarized as in this article

A stable currency is a currency which successfully performs its functions as a means of exchange, unit of account and a store of value because its purchasing power is stable

and

“A currency, to be perfect, should be absolutely invariable in value,”

said David Ricardo in 1817.

So we have this recurring theme of purchasing power, however this might not be absolute

It may seem that “stable purchasing power” is a desirable goal, but this is not at all the same as stable value. For example, if you live in Manhattan, and then travel to Puerto Rico, you might find that the purchasing power of your dollar bills increases by several multiples. However, their value remains the same.

This is probably a topic for an entire body of knowledge of scientific literature, but let’s stop here.

What is a Currency Basket?

From here

A selected group of currencies in which the weighted average is used as a measure of the value or the amount of an obligation. A currency basket functions as a benchmark for regional currency movements - its composition and weighting depends on its purpose. A currency basket is commonly used in contracts as a way of avoiding (or minimizing) the risk of currency fluctuations.

What is a Basket of goods

I don’t want to go into details in this post, however a good example is a CPI :

A consumer price index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. The CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically.

Which Basket(s)?

When looking for a suitable basket to constitute a possible index, you’ll find there are many and with different purposes.

However, when reading up on the matter there is one currency basket that stands out, because it is engineered for stability AND international trades :

Special Drawing Rights (SDRs)

They made their first appearance on this forum here

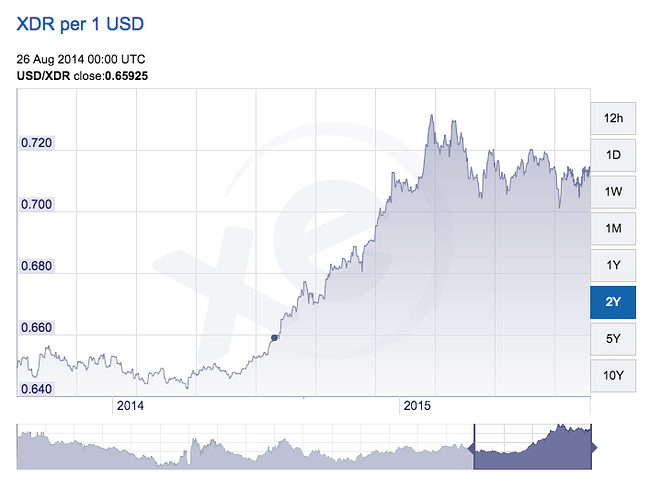

Special drawing rights (XDR or SDR) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF). Their value is based on a basket of key international currencies reviewed by IMF every five years.

This page tells more technical details on the price calculation : http://www.imf.org/external/np/exr/facts/sdr.HTM

SDR price was designed (1969) to be stable and to be used as a global asset for trade and holdings. It is also designed with the scope of reducing volatility of national currencies and provide a stable means of exchange. The price is reviewed on a daily basis by the IMF and is holds strongly especially in times of crisis.

Why SDR?

Using a basket for pegging will drastically reduced the risk of being tight with USD, which is still a national currency.

As an example I want to report on the specific use case of SDR, and I invite others to make other research and proposal on different units

SDR are getting more and more popular in finance, especially after a new paper that aims at improving SDR came out in 2011 titled "Enhancing International Monetary Stability—A Role for the SDR? " (you should read it) .

As declared in the paper, the biggest problem of SDR is that despite their optimal pricing scheme, they are impractical. The asset is not very liquid, not easy to exchange it everywhere, and even harder to transmit from A to B. I believe that a NuSDR could potentially fix most of those problems. The demand from the market is already there and its huge, and we will have a first mover advantage.

Here are some paragraphs which are particularly interesting from the paper :

SDR might help serve respectively the following objectives: […] reducing the impact of exchange rate volatility among major currencies.

SDRs are especially valuable at times of systemic crisis, as they give confidence to the market that the member can access foreign exchange funding without liquidating assets in financial markets that may be impaired or would be subjected to added stress from simultaneous action by several central banks.

Reduce impact of exchange rate swings: The SDR unit of account could be used to price global trade, denominate financial assets, peg currencies, and keep accounts and official statistics. The SDR’s basket characteristic provide a less volatile unit of account and store of value than its components when measured in domestic currency terms, thereby helping cope with exchange rate volatility for both the official and private sectors (see Box 1). These benefits are all the greater as the use of the SDR in both goods and asset markets is developed. Such development would allow the

SDR to serve as focal point for IMS evolution, a more efficient outcome than several segmented markets in various national currencies.

From “Realism” section where SDR problems are listed — Here I think NuSDR finds its space, not suffering from those limitations :

With their use limited to the official sector, official SDR holdings provide an imperfect reserve asset, as they cannot be used directly for market intervention or liquidity provision.

There are tight legal and political constraints to expanding the use of the official SDR, such as the need for an amendment of the Articles to change the way SDRs are allocated or the need for an 85 percent majority of voting power to agree to an allocation of any size.

Allowing private sector holding (and trading) of official SDRs would enhance their reserve asset quality as central banks could use them directly to intervene or extend liquidity to the market, instead of having to go through the Fund’s voluntary market or designation mechanism to exchange their SDR holdings for useable currency, a transaction that can take several days to complete. It could also help spur development of a market in other SDR-denominated assets and contribute to the development of other reserve currencies. Private sector institutions could be interested in holding official SDR based on a calculation that the market may develop further and for the potential benefits of SDR as a source of liquidity. Allowing the private sector to use SDR holdings as collateral to obtain freely useable currencies at times of globalized liquidity squeeze or financial distress could increase the incentives for holding SDRs. This would require consent from key central banks to provide a market for private participants, or opening the Fund’s voluntary market to them, which may require capping the amounts of SDRs eligible for such transactions. Private holdings of SDRs could thus directly contribute to alleviating stress at times of crisis and would mimic the global provision of foreign currency swap lines.

How (ndr. mitigate excchange rate volatility) ? Use of the SDR as a unit of account could mitigate the impact of exchange rate volatility through: i) use of SDR to price international trade, report data on international transactions, and as an exchange rate peg; and ii) denomination of assets in SDR. The latter would require the development of a private market for SDR-denominated assets with impetus from the official sector and support to build the market infrastructure. The rest of this section discusses these issues. SDR valuation is clearly key to determine the optimality for any country or economic agent of the SDR basket as a hedge against exchange rate volatility. It is discussed in the next section. In all cases, an important distinction is between the denomination of certain transactions or securities and their settlement. Use of the SDR for denomination (what is at issue here) leaves full discretion to the parties to choose any currency for the actual settlement of their trade.

Foreign trade pricing. While it might be most advantageous for countries to trade in their own currencies to reduce uncertainty over export (import) receipts (payments), in practice, this would not be a globally efficient outcome. As such, use of SDR invoicing and pricing could be advantageous as it would stabilize export receipts (in local currency) compared to single currency pricing, and more generally would avoid exchange rate volatility amplifying commodity price swings

Pegging. A number of countries peg their exchange rates to a basket of currencies. This may be preferable to single currency peg for countries with diversified trade and investment partners as it better reflects the composition of their balance of payments flows. While the SDR may not be any country’s optimal basket (except perhaps for commodity exporters in a world where commodities were priced in SDR), it has the merit of pre-existing and being publicly quoted, which has both transparency and practical benefits. Moreover, to the extent that pegging to another currency implies importing its monetary policy, an

SDR peg would allow a monetary policy that is representative of global conditions and less dependent on the policy stance of any single economy.

Quoting commodity prices (e.g. oil) in SDR has a number of advantages compared with the current system of pricing in U.S. dollar (except for countries using the U.S. dollar as their currency); including:

Stabilizing export receipts. Assuming that the objective of commodity exporters is to stabilize export receipts in terms of local currency, the ideal pricing strategy for them would be to quote prices directly in domestic currency. However, there are a number of considerations that would make this impracticable or inefficient (e.g. existing pricing practices, where standardized price quotes in a common vehicle currency dominates pricing behavior for homogenous goods, and pricing to market practices). A second best might be SDR pricing for the following reasons:

As basket, SDR is less volatile (compared to component currencies) in domestic currency terms so would provide greater certainty over export receipts, especially as trade is based on forward contracts;

SDR pricing would eliminate some of the volatility of exchange rate movements, contributing to smoother price evolution. Commodity prices would better reflect underlying market conditions.

Natural demand. Commodity exporters are importers of other goods and services from different parts of the world, therefore, SDR pricing of exports would better reflect the evolution of their terms of trade and import bill to the extent that a portion of imports in non-dollar denominated. For example, if the euro were to appreciate against the dollar, commodity exporters with a component of imports from Europe would be better hedged if their exports were denominated in SDR, as part of their receipts would then be denominated in Euros even if it does not exactly match the composition of their imports or the invoicing currency.

Benefit to importers. To the extent that commodity importers have a market-determined exchange rate regime (or simply do not peg to the U.S. dollar), SDR pricing would also stabilize their import bill and, generally, would be a better hedge for the composition of their export receipts.

What I find impressive about this financial index is that is designed and engineered to do what we need to do if we want to achieve stable purchase power AND international trade pricing.

However what impress me the most is that the demand is already there, as attested by the paper, and we could solve a real problem that SDR is suffering from and is refraining adoption : impractical to use now (how would you transfer 10 SDR to your counterparty in Japan) and illiquid.

Well, what’s more practical than a cryptotoken to move value around the globe, and who can provide liquidity if not us?

I invite you to read up on the topic and make proposals

This is why I argue for a NuSDR as a completely innovative product rather than another national currency.