Can @jooize confirm that?

I ve just noticed that the sell sides have been replenished compare to a few hours ago on both bitrex and cryptopia.

The market at Cryptopia has pushed the NuShare up. I don’t have the numbers for how much, but daily trading volume has peaked at $50,000. Alcurex is a more liquid market however, with deposits and withdrawals operational.

A large number of US NuBits entered and exited circulation this week. We set higher walls to accommodate the demand.

2017–05–25

Daily move to equilibrium this week: 1,062 USD in BTC

Move to equilibrium in BTC: 0.41647

NSR purchased: 1,019,358.28482174

Apologies - I meant a massive amount of NBT recently bought (not NSR), which can be seen from @jooize’s reporting, with US NBT circulation up to 300k this week from under 200k last week.

I’m keen that assets rise along with liabilities to a large degree until the threat of an attack reduces.

The threat is high due to recent chance to accumulate lots of NSR cheaply, and the previously very small NBT circulation.

Indicators of an attack being attempted include rapid purchsse of NBT once buybacks start in an attempt to pump NSR price before dumping. This may be happening, and the best defense is to raise the reserve ratio.

However, it may simply be that confidence in NBT has risen among some NSR hders or others due to the reserve target being met. Confident NSR holders are incentivised to buy NBT and hold it, so I hope it’s just this though would like to see a cautious approach.

Also, higher reserves should boost confidence in & robustness of Nu in general, which may be better for the medium to long term NSR value than overly keen (in my opinion) buybacks.

Haven’t seen a lot of activity in transactions on the blockchain, so it is probably safe to say that they are held on the blockchain for hedging (not as store of value or to obtain some interest), most likely in anticipating of a BTC bear market. Will be an interesting test how NSR is going to behave when this happens. A higher reserve rate or more diverse reserve funds is indeed the best response to these risks imo.

Who can adjust that?

@Phoenix by discretion.

NSR holders by motion.

Why is there no such motion?

What are reasons not to increase the reserve ratio?

Who benefits from not increasing the reserve ratio?

Naming BTC volatility as reason, would be a staircase wit. To shy away from keeping BTC in reserve because of volatility, but trading BTC/NBT at low spread at the same time is nonsense.

good question .

I am worried that a bear market will pose existential threats to Nu but compared to last time we have doubled the ratio and we should be able to sell NSR faster at a better price I feel.

A BTC bull market poses bigger threats, especially if it comes after a BTC bear market in which people hoarded NBT to hedge BTC.

In a BTC bull market people exchange NBT for BTC. Sooner or later the reserve runs dry and the desire to exchange (rising) BTC for (maybe not rising) NSR isn’t high, which makes replenishing the reserve difficult.

That was the grand scheme of things the last time the reserve ran dry.

Seeing NSR buybacks now makes me wonder.

Let’s see whether history repeats itself.

Not trying to hurt your feelings, but I doubt that you can sell NSR for thousands or tens of thousands of USD in a short time, which would be necessary, if another bank run like event happened.

I wonder how many of the NBT that are in circulation sit idle on addresses, because keys have been lost, owners died, etc.

If the recently sold six figure amounts of NBT are in the hands of a single actor and are the majority of funds really in circulation, fun times could be ahead

well at the same time in a bear market Nu is likely to sell a lot of NBT because traders would like to lock in a fixed value, so that could builld up the reserves in btc but at the same time bitcoins are decreasing in value, so both movements should cancel out and at the end we have a decent reserve. But ultimately it is not enough and we need to sell NSRs.

Well it is difficult to get a lower price than 6 satoshis so we can be confident that a decent reserve can be created in a bearish market.

Of course nothing is for sure. So we could face unknowns issues.

It is experimental so I do not think standard economics applies.

One thing is sure is that we are a an exciting time for Nu.

Plenty of challenges: decentralizing liquidity provision, liquidity stats, automatic NSR sales etc… need to be implemented. Let s try our best.

Good questions.

Should we start a specific thread to discuss increasing the threshold that could lead to a motion developing, or should we just discuss it here?

The only reason I can think of not to increase the reserve ratio would be that increasing the ratio would put less short-term upward pressure on the NSR price. I’d choose medium to long term stability over short term NSR price.

NSR holders who want to sell in the short term, including potential attackers are probably the only ones to gain from not increasing the reserve ratio.

I’m not really interested in contributing more than I already do.

I think the Chief of Liquidity Operations is a little bit too idle on this matter.

Maybe he’s busy thinking of an explanation about what happened to the B&C dev fund, where the 200 million NSR that are missing went to and why the B&C dev fund was used for minting.

If you want to continue this discussion in a structured way, a separate thread would be helpful, although this topic is directly related to liquidity operations.

@Phoenix, time to defend the peg!

Or let’s say: time to prepare defending the peg. Raise the reserve ratio!

Isn’t that one of the prime responsibility of the Chief of Liquidity Operations?

Do you wait until others do your job and figure out an appropriate reserve ratio? Maybe the current ratio is, who knows?

Only a lousy chief would leave such important topics to others, forum members who don’t even have skin in the game or worse, an agenda of their own!

Or don’t you care, because you have discretion as chief and if you need a formal approval you just can spit out a motion and approve it yourself. You still have voting majority, do you?

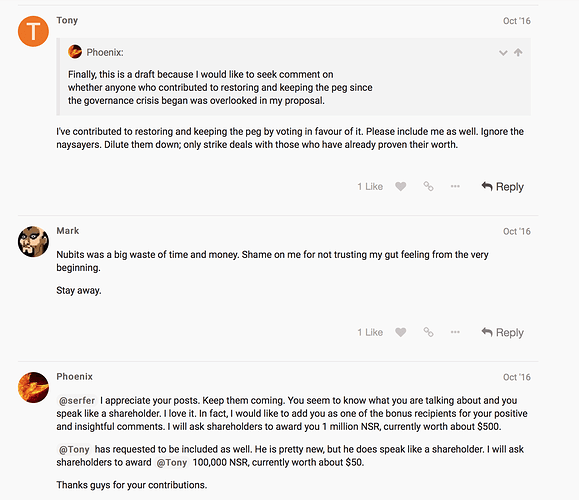

@Phoenix, you could test the waters like @JordanLee did:

Recently there has been less support for motions and custodial grants, most of which revolve around compensation for liquidity operations. There are two competing hypotheses that could explain this:

Some shareholders believe too much money is currently being spent on liquidity operations, so they are reluctant to vote for any grants to fund liquidity operations, resulting in lower support for most of the recent motions and grants.

Some shareholders are not paying attention and not configurin…

2017–05–26

Daily move to equilibrium this week: 1,062 USD in BTC

Move to equilibrium in BTC: 0.42771

NSR purchased: 2,251,105.26315789

Any comment about raising the reserve or the thoughts regarding the recent six figure sale of NBT?

Is the Vice Chief currently limited to executing the Chief’s orders?

Any comment about raising the reserve or the thoughts regarding the recent six figure sale of NBT?

I’d be interested to hear your thoughts @jooize.

Phoenix has said he’d consider increasing the reserve ratio it if the situation looks to warrant it.

Do you think the situation warrants increasing the ratio, given the recent opportunity to buy lots of NSR plus big NBT sale so soon after reaching equilibrium?

I know I’d be more comfortable holding US NBT if I knew that significantly more than 50% of the proceeds of sale were put into reserves rather than buying back NSR at this time. I may be comfortable with lower reserves in the future if there were a wide circulation of NBT and improved revenue models that guarantee a certain level of demand for NBT (e.g. lending).

This is the guy in the driving seat of this project ![]() Looking forward to the BKS dilution, happy to chime in! haha

Looking forward to the BKS dilution, happy to chime in! haha

Any comment about raising the reserve or the thoughts regarding the recent six figure sale of NBT?

I will repeat what I have said before: the only thing I want to discuss with @ConfusedObserver is the return of the 13 BTC he stole from NuShare holders. Even those who wish to harm Nu and prevent its success have agreed @ConfusedObserver stole 13 BTC and ought to return it. His deplorable integrity combined with his known intent to harm the network means he should not be engaged on any other topic. The reason he wants to destroy our precious network is not hard to understand: if Nu succeeds then that will prove the problems with the peg were due to his own incompetence. He wants to shift blame somewhere else, specifically to flaws in the system itself. Having Nu fail lends credibility to his desired assertion that the system was flawed, and there was nothing he could do as @masterOfDisaster. It is unfortunate his interests have become irreconcilable to the success of Nu, but we ought to frankly and stoically remember the motives and situation underlying his ridiculous posts. They come from a felon and person of poor character who has an interest in destroying Nu. We shouldn’t engage or indulge this troll.

Phoenix has said he’d consider increasing the reserve ratio it if the situation looks to warrant it.

Do you think the situation warrants increasing the ratio, given the recent opportunity to buy lots of NSR plus big NBT sale so soon after reaching equilibrium?

No, I don’t think the situation warrants an increase in the ratio. The concern about reserves is probably greater than it needs to be. Nu has never run out of reserves, so it would be a problem that is unprecedented in our nearly 3 year history. Remember, when the peg was abandoned large reserves were withheld, in violation of NuShare holder policy.

The pattern of NuBit purchases (which is all public information), suggest there is a low probability of the NuBit purchases being enacted for the purchase of manipulating the NSR price. Even if this is the case and a large number of NuBits are sold suddenly sometime in the future, we are already well prepared to handle that without even resorting to NSR sales immediately. Holding a reserve is expensive and entails counterparty risk, so too much really is a problem.

There are lots of other matters that I would consider to be a higher priority for Nu. Specifically, marketing above all else (we should begin to spend substantial sums on this), followed by stabilization of the reference client, followed by client development (such as NSR denomination change), NuBot development and development of both real time and historical data about our network, particularly liquidity related info. Those are my priorities. But I can’t manage all that myself. I don’t have any skills in marketing. There is plenty of room for people to step up and help, with the support of shareholders.

Also, if we can get the NSR price a bit higher, maybe somewhere between $10 and $20 per voting NuShare, then I would support actively beginning development of B&C Exchange again. We need that NSR price to fund development, though.

the only thing I want

The only thing I really want is world peace.

Even those who wish to harm Nu and prevent its success have agreed

I’ve made a survey with my imaginary friends just like you did and we have agreed that you are nuts.

incompetence

An interesting word to throw around from the one who not only got funds stolen, but in the process of utilizing the whole Nu network to his own benefit (it’s right that no Nu funds were lost, right? @jooize mentioned that) by blackballing addresses alienated exchanges with amateurish emergency update procedures.

No, I don’t think the situation warrants an increase in the ratio.

Is it you who bough 120k NBT?

The pattern of NuBit purchases (which is all public information), suggest there is a low probability of the NuBit purchases being enacted

Now you are the Chief of Tea Leaf Reading as well?

If you bought the 120k NBT, I would agree that you should not increase the reserve ratio. It would harm your game

of manipulating the NSR price

You need to

get the NSR price a bit higher

instead and dump some of the NSR you got cheap or for free.

Nu has never run out of reserves, so it would be a problem that is unprecedented in our nearly 3 year history. Remember, when the peg was abandoned large reserves were withheld, in violation of NuShare holder policy.

It has run out of reserves approximately one year ago and it took months to recover from that.

What are the reserves you are talking about? NSR that couldn’t be sold fast enough?

JordanLee’s Ponzi Engine is greedy and needs lots of fuel. Sometimes you just can’t sell NSR fast enough to fuel this engine. It has no good design and no good engine efficiency.

Regarding public information:

where are the 200 million NSR from the B&C dev fund that you were trusted with and that are missing?

Why did you use them for minting although you promised not to?

That attitude makes it easy for @Phoenix to get away with his behavior. I did a lot more than asking questions. I was trying to get accounting for this mess started. I was proposing ways to make revenue. That nothing of it was used for the benefit of Nu was the failure of Nu, not mine. Better blame Nu and not me! But it’s easier to blame me. I respond and act responsibly. And that’s no problem in your eyes? He didn’t do anything bad, because it’s hard to prove he did? Fact is: 200 million …

The pattern of NuBit purchases (which is all public information), suggest there is a low probability of the NuBit purchases being enacted for the purchase of manipulating the NSR price

If the aim was to manipulate price, we should expect significant NBT purchases following equilibrium being met.

In the short time since equilibrium has been met, the circulating supply of NBT has increased by 70% (from 180k to 305k in 1 week).

Granted with $247k of reserves, this NBT sale alone isn’t a worry to the stability of the peg at this stage.

However, it fits the pattern, and if the purchasing continues at this rate (with the NBT largely being bought by a potential attacker) it would be 2 weeks / sales of 210k NBT before their stash was equal to total reserves.

So, as you say, not yet a threat, but something to keep an eye on.

2017–05–27

Daily move to equilibrium this week: 161 USD in BTC

Move to equilibrium in BTC: 0.07426

NSR purchased: 742600.00000000

2017–05–28

Daily move to equilibrium this week: 161 USD in BTC

Move to equilibrium in BTC: 0.07192

NSR purchased: 719200.00000000