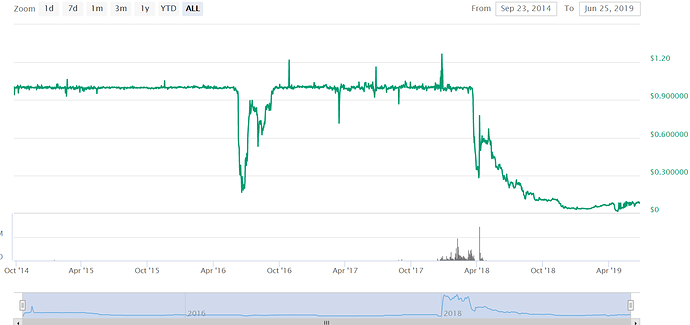

US NuBits were the first functioning stable coin, implemented in September 2014. We have a proud and long history of remarkable innovation. Nu’s approach to pegging is remarkably flexible and economically efficient. The design of the system allows for adaptation to emerging circumstances. Along those lines, I would like to introduce a new program to support the USNBT price.

Essentially, the program permits NuShare investors to purchase NSR on favorable terms by purchasing USNBT on the open market and then burning or destroying it as the actual payment for their NSR over an extended period, such as 13 weeks or 52 weeks. Here are some highlights of what the program allows investors to do:

⦁ Acquire NuShares at a discount to market price

⦁ lock in today’s NuShare price

⦁ increase value of the network with long term weekly USNBT purchases and burns as payment for your NuShares

The program was inspired by negotiations with its first participant: @smooth. As we set up rules around a plan to purchase NSR and burn USNBT, it became clear the network could benefit by allowing other NuShare investors to invest in and support the network in similar fashion. We would like to invite other investors to approach the liquidity operations team at team@nubits.com and agree on a similarly structured program of NSR purchases and USNBT burns.

The basic outline of the process is as follows:

- Someone wishing to invest in the network chooses how much they would like to invest in NSR and how long they want to spread that investment out. The longer they are willing to spread out the USNBT burns, the deeper the NSR discount.

- They transfer their BTC payment to a 2 of 2 multisig address, where the investor holds one key and the liquidity operations team holds the other key.

- The liquidity operations team transfers their purchased NSR to a 2 of 2 multisig address, where the investor holds one key and the liquidity operations team hold the other key.

- Each agreed upon interval of time, which might be a week or a month, BTC (or other payment currency) is transferred.

- BTC is used to purchase USNBT on the open market.

- The USNBT is then burned and the burn transaction ID will be published, proving the USNBT money supply has been reduced.

- NSR is transferred from the 2 of 2 NSR address to an address under the control of the investor.

- Steps 4 to 7 are repeated weekly or at another specified interval until all funds are used and the term of the agreement is complete.

Each participant in the program can choose their own investment amount and the time period over which that investment is made by reaching out to us at team@nubits.com. Below are the specific terms the liquidity operations team has negotiated with @smooth. They are presented as a draft for shareholder comment, and may be modified due to suggestions made:

Terms of the USNBT buyback and burn program for @smooth

The duration of the buyback agreement is one year from when the first NSR for USNBT exchange occurs. After each 13 week period, smooth will be permitted to reevaluate whether to continue exchanging burned, unusable USNBT for NSR or whether to simply purchase and park USNBT. The NSR price for the first 13 weeks is 15 BTC satoshis. The first step in the program will be for smooth to transfer $50,000 USD of Bitcoin to a 2 of 2 multisig address, with smooth and myself each holding a private key. After the Bitcoin is transferred, the liquidity operations team will transfer NuShares held in the team 2 of 4 multisig address to a single sig address specified by smooth. The quantity of NSR transferred will be determined by the quantity of BTC sent to the 2 of 2 address using a price of 15 BTC satoshis per NSR.

Each week, 7.69% of the BTC 2 of 2 funds transferred will be sent to a BTC single sig address of smooth’s choosing. He will use these funds to purchase USNBT in the open market, and then burn them (a transaction that publicly proves the USNBT can never be transferred or spent). smooth or an agent will post a link to a block explorer documenting the burn each week on this forum. When the last of the 13 weekly USNBT burns operations is complete, he may choose whether to receive additional NSR or to instead purchase USNBT and park it for a period of one year. For each of three subsequent 13 week periods, the price of NSR will be determined by the average price each day for 14 days prior to the final transfer of BTC funds. It is at smooth’s discretion at that time to deem the NSR price acceptable, or unacceptable. If acceptable, the same steps will be followed as in the first 13 week period: a BTC payment is made to a 2 of 2 address, then NSR is transferred to a single sig address chosen by smooth. If smooth deems the NSR price unacceptable, he can opt to purchase and park USNBT for the duration of a year. Instead of receiving NSR as compensation for his BTC payment, he receives parked USNBT that cannot be spent for a year, but yields a premium at the conclusion of the park term.

@smooth is acting solely as an independent investor, have no affiliation with the Nu team, and make no representations nor commitments to anyone, other than to carry out the transaction as negotiated and agreed.