someone panicked

Nope. I just explained the situation from my point of view

The claim that it is harder to keep the peg with a tight spread isn’t really true, but a clarification is required. Trading volume makes it hard to keep liquidity balanced. No trade volume, no problem keeping things balanced. Lots of volume, you either need lots of balancing or a lot of liquidity. Decreasing the spread increases the trade volume, but the real issue is trade volume, not spread. If we ask the question “do we want to encourage trade volume or discourage trade volume” the answer is obvious. Of course this creates work, but that is the job of liquidity providers. This is what we do. We encourage as much trade volume as possible. It creates work for liquidity providers, but that is the service we are in the business of providing. Saying we should manage high volume by increasing spreads is like a restaurant raising its prices to reduce their workload. Both actions would make people’s jobs easier simply because it involves serving fewer customers. But they are actions that shrink the business. We don’t want to shrink the business, we want it to grow as quickly as possible. Carrying the metaphor further, we have promised what the price of our product will be. Increasing the spreads is like a restaurant advertising certain prices, and then when they get more business than they would like, raising the price. It is breaking promises as well as discouraging customers. We don’t want to do that.

@masterOfDisaster your work on NuBits has been very important. We all appreciate your work, but you need to keep your life balanced. If you need to back off a bit on the work you do, that can be healthy and necessary. I would just ask for an orderly transition. Continuing with the metaphor, you are a server at the restaurant. You don’t want more work. That doesn’t mean the restaurant should discourage customers from coming in, it means the restaurant needs to find another server who is willing to do the work.

We simply have to develop a system that will support high trade volumes. That is our job.

Indeed. Still, it is a good idea to have some of the lower quality products on hand if the high quality stuff is flying off the shelves and we’re running out of stock. That’s why i prefer gateways to keep some liquidity off T1.1. That and the fact that the network cannot sustain infinite volumes so we need to discuss what the limit is. It takes several blocks sometimes to get a btc txn through, meaning a refill can be an hour away. If we keep some funds at higher spread then we have something to give the people that are panicking to cash out right now this instant while we refill. Of course, only stocking the low quality product cause the high quality one sells too quick is also a bad idea. Happy mediums.

and this is the greatest danger for NU, lack of active community.

Thank you for your clarification.

How can you tell without evidence?

Let me try:

the claim that Nu can keep a peg at all, if only orders at <1% spread are allowed isn’t true!

I have evidence: Poloniex, January 2016.

Sure, but what’s the answer if the question reads:

do we want to stop supporting the peg just because we run out of funds?

If you have a look at the reserve, you might find it’s quite low.

So would you rather have a peg with a worse spread or no peg at all?

If the restaurant is full, you won’t get a seat.

If the weather’s nice and you want to sit on the terrace, but are too late, you might need to sit inside or don’t eat that day at that restaurant.

T1.1 volume gone? Have some of the T1.2 orders!

Did you really understand that I’m for orders <1% spread AND orders at >1% spread to support the peg once T1.1 is empty on one side?

Depending on the reasons for it to be empty, it can be fixed faster or slower.

It depends on the funding of higher levels as well.

I’d never recommend to fill T1.1 from T1.2. Treat them independent from each other.

Replenishing T1.1 from T2. If that’s empty, go to the next higher tier.

T1.2 is a defence for the peg once T1.1 failed.

Using T1.2 to replenish T1.1 undermines the reason for having T1.2 in the first place.

But there is a reason for it at the moment and there was a reason for it in January.

Without the funds at @zoro’s and @Cybnate’s gateways, the peg would likely have been lost at Poloniex today just as it had been lost in January.

The only thing that could have prevented that from happening would have been a stop of trades above a certain spread.

Would you want to rely on that?

Would you rather want to have some funds at a spread that is not exactly attractive, but not horrible either?

This business grows from NBT that get sold and remain circulating.

This business makes revenue from fees that get destroyed.

Supporting trading to a certain degree is necessary for bringing NBT in circulation. People need to know that they can trade them back if need be.

Supporting trading beyond that degree is just increasing the costs - unless you have NuOwned operations at a spread from which revenue can be made.

At a restaurant or a shop it’s accepted to some degree if an offer is sold out.

We are in a trading market. It’s common knowledge that supply and demand are tied to each other. This is what Nu is built on!

I’d never dare increasing the spread on USNBT/USD to levels of NBT/BTC.

But I wouldn’t hesitate increasing the spread of NBT/BTC beyond 1%, if there’s so much demand for Nu products.

The NBT/BTC market is one where Nu offers a synthetic peg. Market rules should apply to some degree to it.

Lots of demand? Sounds like a reason to increase the price, which is in this case the spread.

Economics 101.

Where exactly did Nu promise to offer USNBT only at a tight peg in the USNBT/BTC pair?

Why then is it impossible to get a simple truth through?

Orders only at 1% or below will first kill the peg and then Nu; maybe it ruins only the brand image.

Each BTC price jump you are at risk of running dry on all tiers 1 to 4.

Activating T5 takes time to kick in and T6 might take even more time.

The peg will fall unless traders are “friendly” and don’t trade at high NBT/BTC spreads.

Orders at an increased spread buy time and guarantee the peg at least on the spread they run on as long as they have funds.

This can only be mitigated by keeping an increased BTC reserve, but that increases the collateral risk.

BTC price drop is a bit more kind, because you can just print as much NBT as you need to buyall the BTC, which in turn may continue to lose value.

Once your motion to force all new operations to below 1% passes, I’ll take that as sign that I failed convincing people that this road is dangerous.

We’ll see what happens then. Maybe I’m wrong. I dearly hope that I’m wrong, but I trust my experience and my gut.

Jordan, don’t get me wrong. I admire what you designed, what you and the dev team created.

But I dare say that I’m more up-to-date with the motions that regulate liquidity provision and that I have more experience with it on an operational level.

A well thought-out design might not necessarily fit in the real world.

You are trying to design the spread of liquidity provision.

I made a very similar proposal.

It’s pretty much the same as yours and I shamelessly copied most of it.

It’s almost the same, but for one important difference: I have a backup plan included: gateways that are allowed to run at an increased spread.

If the shit hits the fan, they’ll be there.

The shit already hit the fan twice and they were there. @zoro had an easy time, because his NuBots already were on an increased spread.

Believe me when I say, it was worse in January when I had to learn how important it is to have orders at an increased spread.

But do you want to know what’s even worse? Having no gateways at all, because there’s no funds for them after tiers 1 to 4 have been emptied by the next BTC price jump.

Your proposal is the one from an architect.

Mine is from one who fights for the peg in the first line, who suffered and learned from it.

It’s not the work I worry about. Did I ever be suggestive of that?

It’s trying to deal with more guests than can be seated or fed that should worry you.

If all funds are gone at one side, because strangely a parametric order book and market awareness (yah, we don’t have that coded, but it can be done manually) are no longer good ideas, somebody will get no seat and no hamburger.

Poor lads.

I thought getting uses cases for utilizing NBT and destroying NBT would be our job while we keep a low profile on trading at exchanges (rather than risking the peg by trying to bite off more than we can chew)?

Or finally getting trading volume on USNBT/USD or creating fiat gateways?

Anyway, may the liquidity be with you!

What a Jedi way of wishing good for Nu.

MoD suggests provide premium seats that cost more but are probably always available. Sounds like a better business plan.

If a knife is too sharp its edge is easily dulled.

We all know @masterOfDisaster loves our network and he understands liquidity operations very well. So when he gives us cautions like he has in this thread about a 1% spread, it should give us pause.

masterOfDisaster has stated that he believes the peg cannot be kept by using a 1% spread maximum. Let’s explore that claim a little. Keeping the peg, at least in the time frame you are talking about, is a matter of ensuring that funds move smoothly and quickly enough between the various tiers. We have made a lot of progress in facilitating decentralised transfer between tiers. However, it is clear additional development should and will occur. @masterOfDisaster are you saying that right now you believe funds don’t move quickly and smoothly enough to support the trade volume associated with a 1% spread? If that is the case, do you agree that we should prioritise working enough of the friction out before we move to 1% spreads (assuming my motion passes)? What do you think it would take to get liquidity operations to a place where they can support a 1% spread maximum?

Pertinent questions.

The basis to problem solving is asking the right questions.

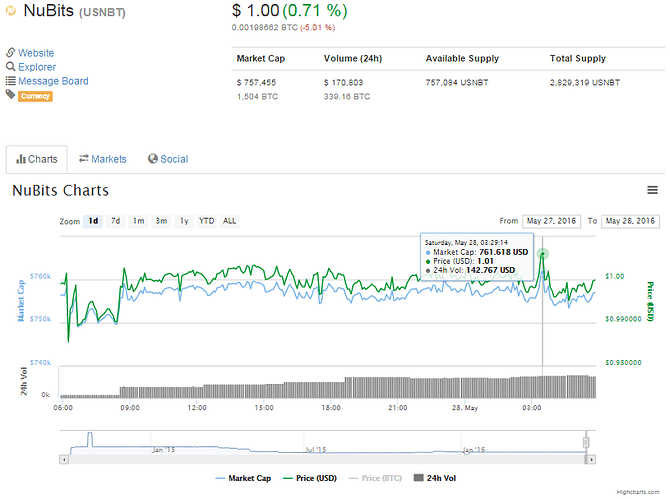

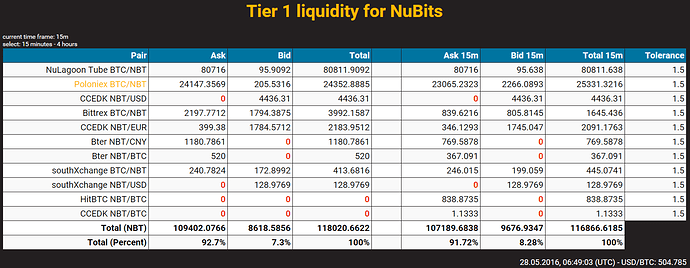

Nulagoon tube have ZERO BTC

I say that with 10-15% of liquidity in T1 and the same order of magnitude in reserve (in normal situations), there’s neither enough reserve nor sufficient speed moving funds around to deal with BTC going haywire if you have no last line of defence that stands.

The only solution I can think of is one I created in in January this year. I didn’t aim at creating it, it was rather an evolutionary process that included trial and error and was made in many iterations.

I don’t want to repeat it all, a lot of it is buried here in the thread.

e.g. Current Liquidity - #1121 by masterOfDisaster

If you want to follow the development, read this thread and posts in [Passed] NBT EXIT gateway on Poloniex provided by @masterOfDisaster and [Passed] NBT EXIT gateway on Poloniex provided by @masterOfDisaster

This was the result:

I ended at spreads of 1.8% and 3% for the two gateways.

A part of it is the case and from what I can tell, Nu was reacting fast until the BTC reserves up to tier 4 were depleted. Actions like activating NuSafe and preparing NSR sale (in addition to the one required by “Standard and Core” motion) have been initiated.

We are already quite fast considering that we need consensus at some places. It would be faster with responsibility being less distributed. We distributed the responsibility for security reasons. If we find room for improvement, I’m all ears.

I try to make the story short. I’ve already written too much in the last hours.

I’ve learned that the peg can be supported by gateways (and of course other operations) at an increased spread.

A lot of the trading on exchanges seems to be done by bots, which just don’t buy outside a certain spread.

If we don’t want to rely on that, we need to have funds on the order book at that increased spread.

If anybody for whatever reason wants to buy/sell NBT in the NBT/BTC pair, there are those orders at an increased spread.

As long as they last, that buys us time to replenish T1.1 while still keeping the peg, albeit on a degraded level.

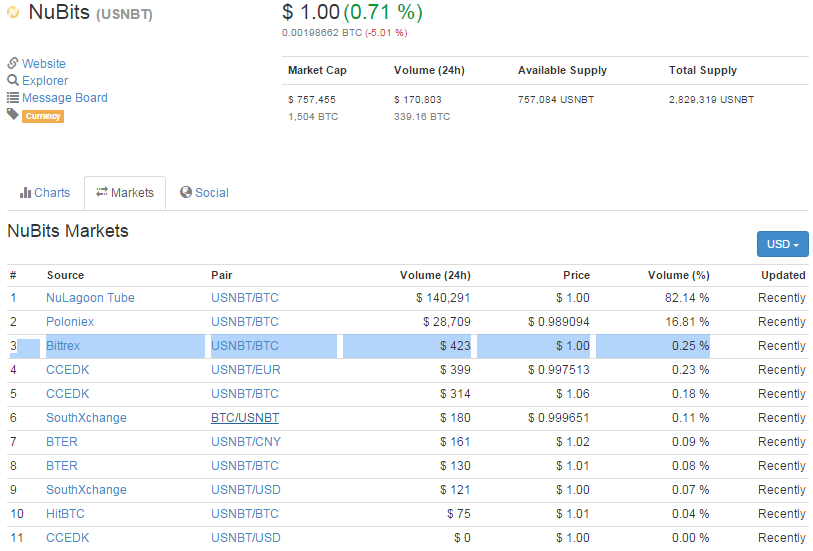

I dare say: without the NuBot by @zoro at an increased spread, it wouldn’t look like this:

This NuBot traded a little more than $3,000 in Bitcoin since I last had a look:

Sat May 28 06:48:58 UTC 2016

status of zoro dual side NuBot at Poloniex:

nud getliquidityinfo B | grep BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo -A 2

"BJs4YbtaqCmxeHLiR6zzjnZEotYVFAPfMo" : {

"buy" : 5833.54,

"sell" : 15194.3455It would have been empty on buy side since long ago, if it were operating at <1%, just as NuLagoon and all other operations are:

The exception seems to be Bittrex.

@Cybnate, I don’t know how much of the reported liquidity there is from your PyBot (running at 1.4% spread, right?).

I beg you to increase the spread of this PyBot to at least 2.x% if you want the funds to last.

This pretty much sums it up:

I always aimed for the medium spread with a smaller amount of funds than Zoro. Like my proposal I’m the first line of defence when ALP runs out (which should always provide a high quality peg at <1%). Zoro goes beyond that and that is good. My proposal is set on 1.4% so I will need to pass a motion to make increases happen and I’m not sure that is useful right now. FLOT can decide to transfer some of the funds to Zoro instead of my Pybot, so there is already flexibility in the system.

Edit BTC just broke the $500 and appears to be rising fast, so we have an extraordinary and unprecedented situation. No-one know where this ends. I agree that a low quality peg is prudent as long as this appears to be going.

Do you still have BTC at Poloniex? Or have all been traded to NBT?

No nothing on Poloniex, only 3.5 BTC on Bittrex. Bittrex seemed to start hedging and bought some NBT today.

@zoro’s NuBot only traded $3,000 of the $9,000 on buy side.

Can you see how an increased spread made his funds last longer?

If you want the funds on Bittrex to last, increase the spread!

…before traders find “cheap” BTC there…

I didn’t had BTC for a long time on Poloniex. Only yesterday 2BTC was hedged temporarily but sold again a couple of hours later. I think my bot just did what it was supposed to do. Zoro is the last line of defence imo.

You do understand why you got the BTC traded soon, while @zoro still has BTC left?

At Bittrex there’s no gateway, but yours.

There you are the last line of defence!

Sadly, your BTC there will be gone soon.

At the moment the peg looks great at Bittrex:

Once your BTC there are gone, it might look worse than it currently does at Poloniex (the line above).

edit: gotta go. Cya.

PS I’d be interested in knowing how long your Bittrex BTC lasted.

I was surprised that my nubot still has btc in buy side!

It’s no surprise to me.

It works like I designed it.

Thank you for following my recommendation.

You did Nu and yourself a favour!