Also keep in mind that we are paying significantly less for that liquidity as it is mainly fiat focussed.

The NBT/BTC pair on e.g. Poloniex is heavily subsidized for a number of traders who earn good money and for some nice statistics on coinmarketcap.com. We need a paradigm change indeed!

to test and ascertain asap

Liquidity Providing must have a solid business proposition to attract new comers interested just in making money

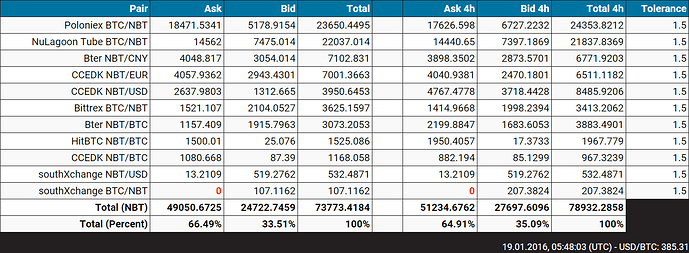

Just in case somebody gets nervous looking at ALix:

The dual side NuBot (formerly known as “NBT exit” or buy side gateway) has 24 BTC, of which only $2,000 at a time are on order (with an offset of 0.009). So there’s a lot more buffer than the eye can see at first glance.

The liquidity is being broadcast. As long as it stays this ways, there is a defense layer:

status of buy side gateway:

nud getliquidityinfo B | grep BFGMPykfKxXZ1otrCZcsbnTwJjKHPP9dsP -A 2

"BFGMPykfKxXZ1otrCZcsbnTwJjKHPP9dsP" : {

"buy" : 9342.79,

"sell" : 11919.2544The buy side is low, because nupool can’t attract much ALP volume to Poloniex at the moment:

It does not seem to be broadcast as T2 into https://raw.coinerella.com/?liquidity.

Also, T1 in https://raw.coinerella.com/?liquidity does not match T1 in https://alix.coinerella.com/walls/?4h .

Why?

Edit:typo

Maybe coinerella isn’t gathering all T2 information?

Can you see that broadcast liquidity information?

I wouldn’t be surprised if this is the reason making people nervous about liquidity provision: [Outdated] (limited) Warning about Poloniex.

There’s now a ‘(limited)’ in the title (I took the liberty to add that after reports of successful withdraws surfaced) and there are lots of reports that the withdrawal works, albeit slower than usual.

The explanation might be closer to this:

in getliquidityinfo B, yes,

This data is coming straight from a nud which averages 50-60 connections.

Decentralized data gathering is a real issue when you need reliable data. You never know who will get which information at what time.

How do you specify this liquidity to belong to t2 in the first place?

This is the combined T1 and T2 liquidity reported by that NuBot (sum(T1+T2)).

If you want to see the T1 and the T2 details, use getliquiditydetails instead of getliquidityinfo.

The output unfortunately is crowded and I don’t know how to remove former sessions. NuBot seems to not remove them automatically (I don’t even know whether the can be removed).

The current session is 0.3.2a_1453183358209_90b9fb.

The details for that are:

nud getliquiditydetails B | grep BFGMPykfKxXZ1otrCZcsbnTwJjKHPP9dsP -A 300 | grep 0.3.2a_1453183358209_90b9fb -A 2

"1:NBTBTC:poloniex:0.3.2a_1453183358209_90b9fb" : {

"buy" : 2000.0,

"sell" : 2000.0

--

"2:NBTBTC:poloniex:0.3.2a_1453183358209_90b9fb" : {

"buy" : 7342.78,

"sell" : 9917.1642By the way is T2 put on order away from the peg center in the parametric order book scheme or it isn’t (only sitting on exchange)? In order words what s the definition of T2 now?

It needs to defined anew:

In the case of the Poloniex NuBot, the T2 is on exchange, but off the order book.

Parametric order book is effectively disabled.

T2 is anything over 5% or off the order book.

What’s T3 then?

Off exchange, ready to be converted to T1.Best within x minutes?

The definition of T3 hasn’t been changed.

That!

Have a look here:

T3 tends to be a specific address where you can just look at the balance of the address to verify the reported T3 liquidity. The type of contract is another story, but as far as what defines liquidity as T3 is that of a contracted address that is not controlled by a Nu elected multisig. According to my definition, technically JL’s BTC address is T3 not T4. That was in fact my starting point for trying to make the trusted T3 grant: attempting to emulate and scale up what JL was doing.

Not only according to your definition!

According to Finalized evolution of liquidity operations it’s de facto T3.

Your efforts are highly appreciated!

JL defines T4 as:

But then I think we’ll find that the phrase ‘liquidity operations’ lacks definition.