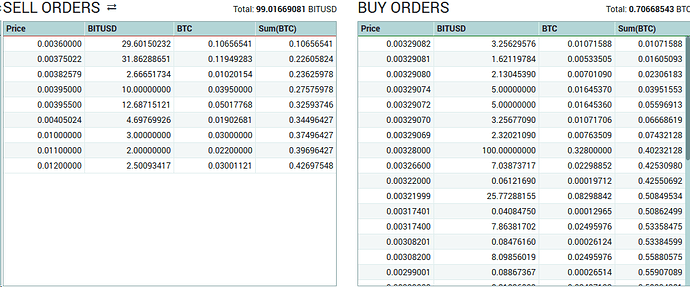

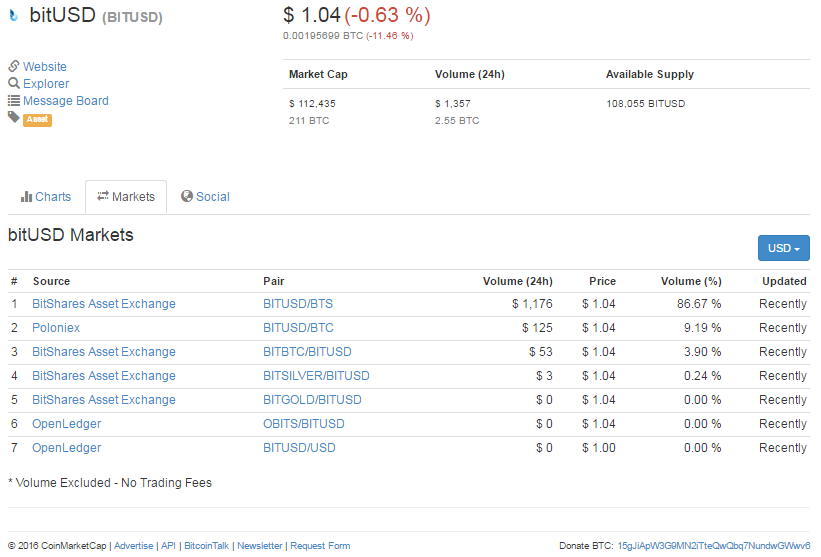

You can currently sell BitUSD for $1.07 on Poloniex. Not with terribly large volume, but the order book is pretty thin. I sent a request to CMC to add the market.

So when do we see the bitUSD/NBT market?

is this a trap question?  i guess they will need the same (similar) bots as we have

i guess they will need the same (similar) bots as we have

Bitassets ends up with a fixed cost model of liquidity provision (paying LPs on their virtual exchange with bts). Sound familiar?

Clearly there’s differences with our model. I just find it interesting that they’re using the same language we are.

That’s not true anymore

That is new info I am not aware of. Do you have a link with details?

I’m not super up to date on everything, but here’s some talk about it from a year ago:

https://github.com/bitshares/bitshares-0.x/issues/1273

I’m pretty sure this is now a variable in the code that a shorter can specify when they create a bitasset.

That was an issue in their algorithm who waited for the collateral to devaluate 75% (3/4) before executing it.

Devaluation limit before collateral execution is designed to be 50%. If the collateral goes to half its price it is executed. With the other code it waited to be 75%

If I wanted a BitUSD I would have to put 2 USD as collateral in form of BTS + the one I want to buy = 3 USD (note the 1 USD to pay for BitUSD is part of the system, and thus considered collateral in the 300% expresion).

The bug waited until the value of USD to BTS declined until the point those 2 USD of BTS was 75% less (0.5 USD total in BTS prices) instead of the wanted 50% less (1 USD total in BTS prices) to “eliminate” the BitUSD contract.

It is still at 300% when created, and from then forward in time is, at least 200%.

Now it is not enforced, the minimum collateral is 175% now, so >275% of value at all times.

Section 2 paragraph 2 only promises 100%.

Yes, plus the payment for the BitUSD:

That’s bts 1.0. It doesn’t mention that anywhere in the 2.0 white paper. Instead, on page 5, it talks about how shorters provide >100% collateral to keep above the price feed and the least collateralized position. It doesn’t have to be 300%, it doesn’t even have to be 200%. It’s just a promise that it’s >100% collateralization.

Is exactly the same.

That math takes into account the price paid for the BitUSD, the collateral per se is actually at least 100%, hence the promise >100%.

You keep quoting yourself instead of the whitepaper. You are not a good source, the white paper is. The white paper says the shorter can choose their collateral, and has incentive to give >100% collateral to avoid being settled immediately. There is no promise of 300% even at the time of bitasset creation. If I am wrong, please cite a source (other than yourself) proving so.

“A short can minimize their exposure to the feed by providing enough collateral to keep far above the least collateralized positions, and thus stay very unlikely to be forced to settle at the feed or at an inopportune time.”

I quoted the explanation, I understood you did not agree with the 200%.

It seems that 175% is the minimum now, so >275% collateral into the network to create a single BitUSD. That is the minimum and only covers for a decline in BTS price of -12.5%.

You were right in that it is no longer enforced at 300%, but It does not make any actual difference since you will have to put into the system at least that 300% level so the position is reasonably covered.

Where are you getting the extra 100% from? So in the example provided, 10000 bts is collateral for the creation of 10 bitUSD with a 1.75 maintenance ratio. That means the collateral won’t be used to buy back the bitUSD until the price is $571/bts. At that moment, the network has $10 debt and $17.5 collateral, or 175% Collateral Ratio (CR). Where’s the extra 100% come from? Who holds it, and in what form if it’s not in bts?

Also, the maintenance ratios are set by witnesses, not hardcoded in.

From the person who buys the BitUSD, that page only covers the collateral for the margin position.

The minimum of 1.75 seems hardcoded according to this BitShares developer:

The BTC rollercoaster that is an immense challenge for our network made me wonder, how competitors, other concepts to provide a “stablecoin” do.

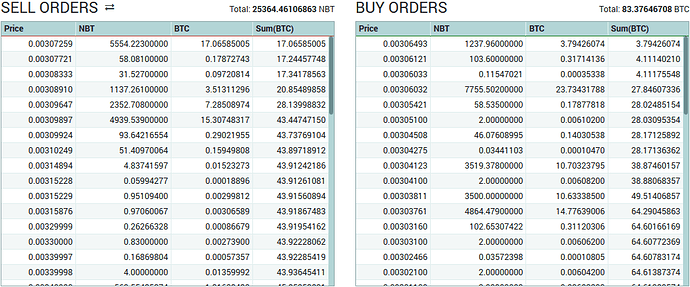

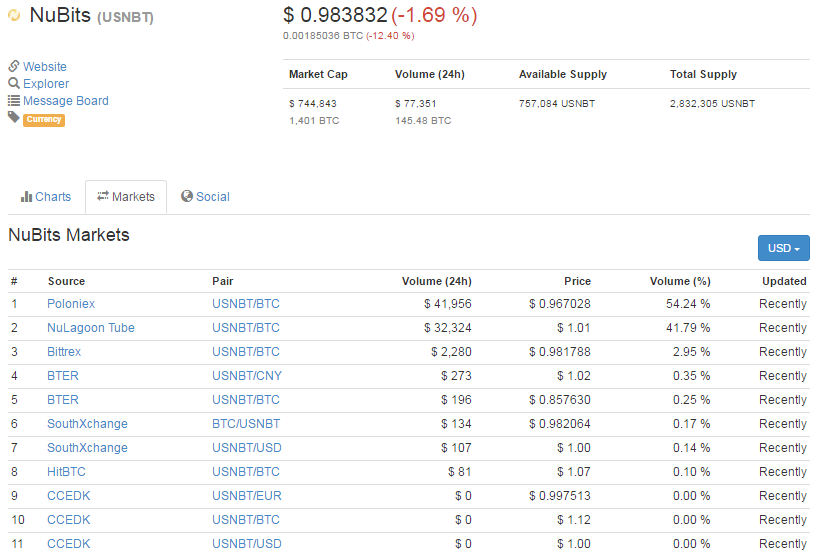

Our peg is still in impressive shape considering the shortage of funds on reserve:

bitUSD on the other hand has almost no volume AND a worse peg:

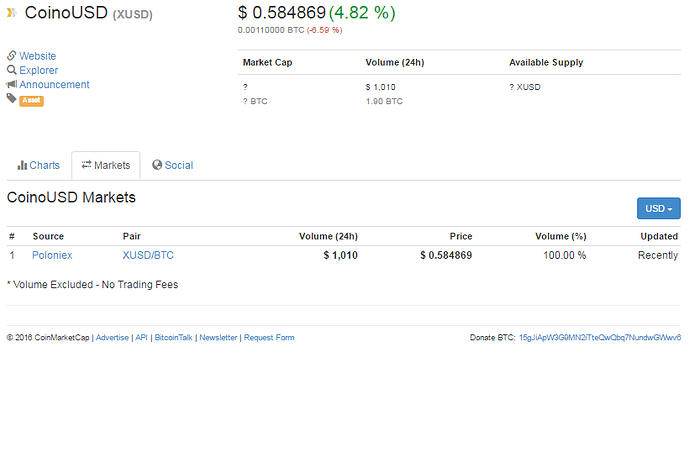

coinoUSD isn’t in the thread title, but I felt like looking at them as well:

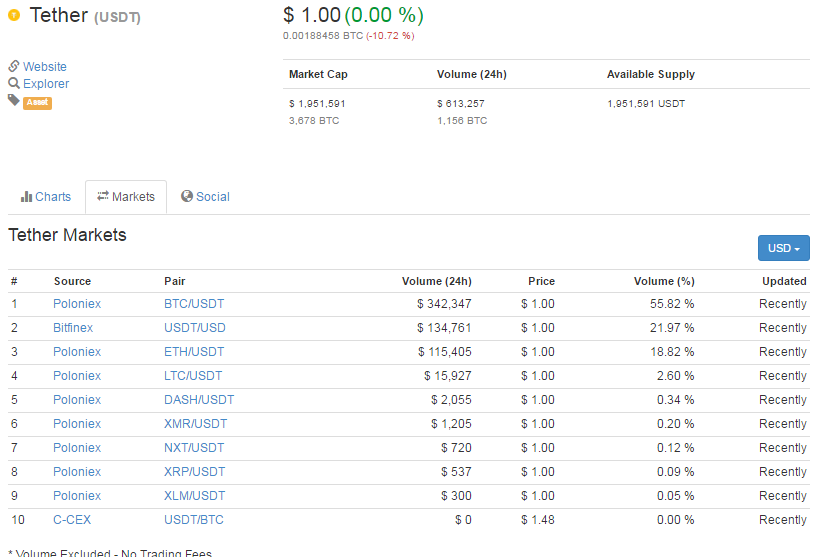

and finally USDT (Tether) - they will always have $1 no matter what rates are on exchange, only I don’t know how, because the BTC/USDT at Poloniex is far off from BTC/USD other exchanges:

Despite all the current trouble, I consider Nu in one of the best positions in this market!

How does tether cope with volatility.

If they offer liquidity against bitcoin, they need to replenish their reserve constantly.

They can probably move lt faster. Their reserve is probably just a cold wallet at Poloniex or Bitfinex.

And they don’t have a fractional reserve as us, so they won’t run out or are faced with selling depreciating assets.

They live from the transaction fees as Bitfinex, Poloniex and Tether are closely tied together I understand.