Looking great @willy

Thanks

Update:

I haven’t received any feedback for the json data so far. If you need something changed, tell me.

This is quite a quick solution and the json structure currently differs from the plain ?json , but I don’t know what you guys do with the data, so I’ll leave it that way for the moment.

Would versioning the JSON feed somehow be a good approach for you to be able to continually improve it without breaking usage?

@willy, you do a hell of a job!

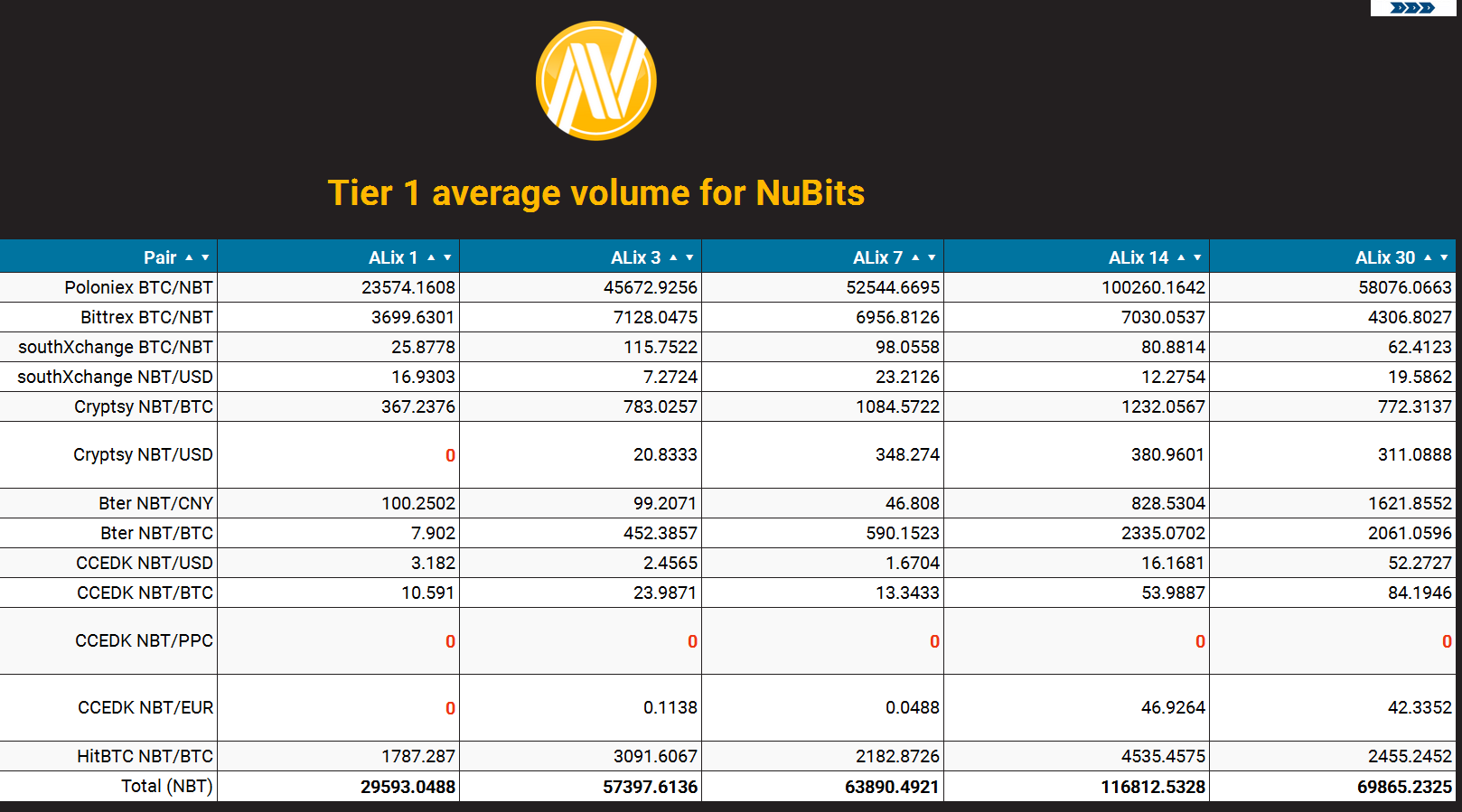

Providing this kind of liquidity information will not only be valuable for NSR holders and the FLOT to base decisions on it, but for (potential) NBT purchasers as well.

Knowing that there’s sufficient liquidity to get the NBT traded back to BTC is important for people hesitant to jump on the “NBT stability train”.

ALix has been added to nubits.com: Liquidity Pool Marketing

If you would like a different page linked to, or additional pages, please let me know. This is a great service that will help shareholders make better informed decisions.

First of all, thanks for the kind words to @masterOfDisaster and @tomjoad.

@jooize I will consider API versioning if major changes, like changing the data structure or URL changes, will be needed. The existing URLs and json structures can be considered persistent for the moment.

As for the current status of the Beta:

ALix Volume - I haven’t tinkered with the code or the raw data in about three weeks, which makes me very happy. The whole process is very resilient and I’m confident that I can lower my monitoring activity in the near future. The GUI is new, so let’s see what feedback I’ll get for that in the future.

ALix Walls - The good news first: I myself consider the data shown on ALix Walls to be reliable. I’ve been monitoring the pairs closely for about a week and a half now, and I’m content with the reliability of the gathering process. The HA server structure is working like a charm. We achieved 99.95% uptime so far, according to pingdom.com. The outages I can see are usually shorter than a minute and only occur in certain regions on this planet. I guess this is a minor problem on CloudFlares end. Needless to say, the backup server wasn’t needed so far.

I wrote a little something on Daology and I’ll approach a couple of people with my draft proposal there, before I’ll publish it here. Expect it to be public before the end of November 15.

If you have any feedback for me to improve this beta, keep it coming!

It may be possible by using “live” images. Basically a remote server would update an image link with a new image periodically (that contains the new data). When someones posts the link here and loads the page it grabs the most recent version of the image. So as the remote server updates the image it would be updated on this page as well. We would have to turn off image caching for that domain, but it’s possible.

This beta has now come to an end after only four weeks. I received so much feedback and the code evolved so much, that I can hardly believe it my self.

I mentioned a contract in the first post, as you might remember.

Well, I published the proposal a few minutes ago.

Check it out here:

Have been monitoring Alix and the Nu client for a while but I notice a difference between Nu client reported Tier 1 liquidity and that what shows up on Alix. Nu client seems to be balanced reasonably all the time but Alix is most of the time unbalanced. Can someone shine some light on this? To me it appears that one of the two must be wrong. I’m concerned about this as most of the liquidity balancing done by FLOT appears to be sourced from Alix. Does this mean that the reported T1 in the client is wrong? Do we have rogue custodians?

I’ve added a picture of both at the same time as evidence.

NuLagoonTube is reporting as Tier 1 with 10k sell side. You can use ‘getliquiditydetails B’ in the debug window to analyze it.

Thanks for pointing me to that. It still leaves a 5k+ gap though.

It’s quite hard to tell.

As far as I understood @desrever, the current version of NuBot only reports the best price order as t1 liquidity in case the custodian uses parametric order books.

That could explain that 5-7k gap, which I’m monitoring myself for the last 2-3 days. Parametric order books are my favourite explanation so far.

Plus there’s still this issue:

edit: just for the record - this issue was solved. @desrever showed me how to correct that wrong broadcast information.

Fixed.

Servers will be moved 23:59 UTC this day.

fixed.