Very easy to understand Sentinel, thank you.

Oh my, this was quite a read.

So basically we find ourselves in what you could call a black swan event. Which for us is low reserves during a BTC surge. The reason for our low reserves where the BTC buybacks we performed earlier this year. In hindsight we used way to much BTC to buy back NSR at highly inflated prices. I think we can now all agree that the amount of BTC we used and the way we conducted the buybacks was a disaster in hindsight, alas it is done we need to move on. Since then we have per motion increased our reserve targets (from 15 to 25% iirc and even that might be to low), so our reasoning for doing so seems more valid now than ever.

However in the light of the current BTC rush (gold rush if you will) our reserves were not enough to withstand the selling pressure, seeing as our reserves became next to depleted (with maybe 20-30k USD value left) @masterOfDisaster in concordance with consensus from other shareholders and FLOT members (however without motion) initiated to increase our buy offset in a last ditch effort to prevent the peg from a total collapse. In taking such a bold but brave move we’ve seen a reduction of selling pressure and have been able to maintain a weakened peg.

Now we have @JordanLee who argues that the increasing off the buy offset to 0.95 cents has subsequently weakened the demand for Nubits and thereby reducing T5 effectiveness and indirectly caused NSR price to collapse and thereby reducing the T6 mechanism. While I feel his reasoning is logically correct so is MoD’s, and quite frankly we don’t know who is correct and we never will. It could very well be that if we had thrown the last few BTC we had into tight spread liquidity provision this would have created more demand and turned out the way Jordan describes it. It could also very well mean that all funds would have been depleted and a complete peg collapse would have left us with an even bigger decline in NSR value and people desperately trying to dump NBT for 10 cents or less.

We just don’t know and we never will. I’m inclined to agree with MoD’s reasoning and I feel that running a bigger buy offset has preserved (albeit weakened) the peg and has prevented a bigger decline in NSR value or NBT dump panic. I feel the demand for NSR was already very weak and the moment we start selling NSR to uphold the peg a price decline is inevitable (as we have recently seen).

Instead of a witch hunt after liquidity providers responsible for the increased buy offset we should focus on sending out a message that we will increase our reserves and be more conservative with proceedings from NBT sales, so that in the future our reserves can withstand way bigger hits then the ones we see today. That I feel should be our message. The most valuable thing we have are the active shareholders contributing to the community for peanuts for compensation we should treasure those persons and not prosecute them for a “mistake” that might very well not be a mistake at all. Also @JordanLee I feel that if you feel so strongly about this you should have stepped forward way sooner when the steps to increasing the buy offset were being taken.

This event was easily predicted a year agao, after using very basic accounting knowledge.

We are deserved what we have done, no regret.

I support Jordan this time, let him prove his belief.

- If he is right, he saves Nu, great!

2)If he is wrong, Nu die, abandon the ship. Well, nushareholders have some BKS after all. If B&C become success after Nu’s lessons, you can recover your invest.

Let’s move on! Die or survive!

I disagree I don’t feel this BTC rush was easily predictable if it was it would already have happened. Did we however lower our reserves to much? Yes that is now obvious and that was also Jordan’s call so he was wrong before he might very well be wrong again.

So increase target reserves and move on (nsr sales will adjust accordingly). This lambasting of people making the best of a shitty scenario is such crap.

Cash flow impluse is difficult to predict, of course, but the asset-liability status will tell truth.

Nu will face today’s situation sooner or later even BTC is always stable.

I said in May 2015.

If Nu is a company, Jordan is wrong; if Nu isn’t a company, Jordan maybe right.

Very quickly

- I am not against firing and new blood and self improvememt

- what is the definition of firing and replacement?

- every member is invaluable in the sense that we need as many shareholders and ideas as possible on a blockchain-based business

- I thought that increasing the spread would not create a deviation from the 1USD mark, but just some leeway for us to operate

- there is no CEO nor managers and every decision and direction should be submitted and tested to the 51% PoS consensus.

- We should quickly submit to the test of such consensus the following

- what it means to peg for US-NBT

- why are we in such a situation for NBT ($ 0.950966 (-1.42 %) ) and NSR ($ 0.001362 (-6.45 %) )

- new liquidity paradigm for NBT, if any

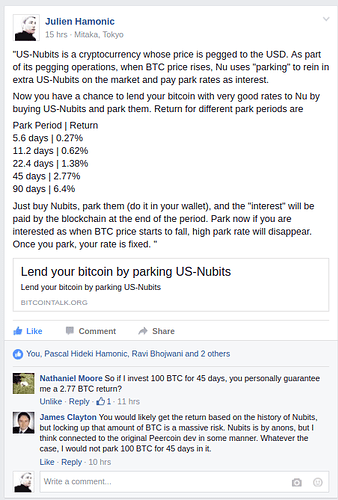

By the way, what some bitcoiners think about NBT parking:

Quite possibly the problem remains that the peg is hard to to defend in a BTC rush.

This would be because people would rather a fast acceleration of coin worth, more than Nu interest, crazy high or not, and that the exiting of users from Nubits would would drive NBT lower. The demand for BTC would mean that the lower price of NBT or Nushares would not entice people into the assets.

It is also very likely that the overwhelming number of assets and currencies has diluted Nu’s and perhaps BC exchange’s appeal (as there is a steeper learning curve of the deep mechanics than BTC/LTC.)

The only redeeming arena I see is BC Exchange, when its built and traders come.

OR bide time (and hold some BTC until [speculated] rise), so that the Nu community has greater “worth” in BTC.

@JordanLee, @masterOfDisaster, @tomjoad -----Thoughts?

This is golden. All shareholders who belive in concensus-based DAO should not vote yes to this motion for its divisive tone, witch hunting tactic, and self-defeating blame-the-workers. The architect should be responsible when wielding his influence power. The same power sent the buyback motion sailing through without being questioned. Power centralization is 100 times more harmful than a 5% offset, as it threatens Nu’s reason of existence.

If you want to support Jordan’s tight spread, vote for his motion [Passed] 1% Maximum Spread in Shareholder Funded Liquidity Operations

Getting that off the way, the issue at hand is still not resolved: is a tight spread like Jordan specified going to attract liquidity or leaving some fund at higher spread safer?

From my casual currency exchange experience having 5% fluctuation for a pegged currency is acceptable, as long as it is expected. We cannot compete with exchange-issued USD token in pegging to the USD because exchange-issued USD token IS the USD in an exchange. So far Nubit is the exchange-issued USD token only on SouthXchange, where NBT/USD pair has 0 spread. Even Nubits can outdo exchange-issued USD tokens, on-exchange trading doesn’t bring profit to Nu unless exposure to BTC volatility is largely eliminated. So a priority for on-exchange Nubits trading is controlling exposure to BTC volatility, or we will be chasing our own shadow.

Nubits is transferable with little friction among exchanges, while the friction of USD flowing between exchanges are ~3% (one way) and several days. Nubits only needs a 2% offset to be competitive in that field.

A sustained spread that is 1% or less is certainly good for Nu’s reputation. However according to my calculation even without NSR buybacks the reserve will run out in early July if BTC price keeps going up. So before we have an effectively 100% backing (reserves and insurance products) we should seriously doubt if promising a 1% peg is appropriate in general. Liquidity ops in the last 10 days shows that a 5% buyside peg is sustainable.

Going forward from here I think the rational steps are

- using parametric order book that extend the wall from 1% - 5% on gateways to commit fund to 1% spread while leaving some for tomorrow.

- Incentivise LPs with Fixed Cost scheme or its variant.

- Raise park rates but leave long terms (>= 3months) to 0 to show that we are not exposing Nu to undue long term liabilities.

- Immediately start working on reducing BTC price exposure by putting BTC reserves in USD tokens automatically.

- Increase reserve line and explore insurance options, the goal being 100% backed.

- Explore Nubits usecase outside exchanges.

- Better PR effort

You should just reply: if 45 days is too long ten how about parking 11 days?

We give people options.

I see a lot of concern here for feelings and and politeness and such. So I ask, are you in this to win, or would you be satisfied with failure so long as everyone was polite and had the warm fuzzies? If the latter is true of you, then I don’t care what you think. Go away. I’m in this to win.

We simply can’t afford the types of mistakes that have been made with liquidity. Do you all understand that? Let me say it again: the network cannot afford these kinds of mistakes. As in we we don’t have the money to indulge these kind of missteps. Think about that.

If we prioritise something besides winning, we will likely fail.

@JordanLee

It has very little to do with “warm fuzzies”. Thats the pejorative term for “respect”, which did not seem mutual in that debate. Communities and groups dissolve quite easily when there is a lack of mutual respect. Please take this very seriously, as seriously as you take an economic peg. If you dont, I believe you will be sorely mistaken in the equal priority of process and project.

“Winning” is hardly the point. Longevity of mission, project, and community is greater than beating ones competitors. Competitors usually beat themselves (as bitshares did when they had a organization feud [and is still suffering from this], or bitcoin core [but got through it-somewhat], the EU [greece exit], or the dollar [few regulations on banks/hyper accumulation of wealth]).

Bitshares has a possibility of taking off, but I think there is skepticism from traders, and the interface is wonky and unclear. There are also too many user assets, and not enough liquidity on the exchange.

As for economics, I would like to see some projected numbers of where money will be obtained if peg is kept at 1$ and is ate up quickly.

I would also like to see the projected numbers that say a 1$ peg will be eaten, leaving no future funds.

Both are equal logical possibilities, and deciding between them needs data, not arguments.

When we decided to issue a stable curency in 2014, we have entered a very dangerous water. Our task is much harder than most alt coins, because stable monetary issuance is a forbidding topic, some may not perceive this.

If we, people from all over the world, with defferent professional background, want to be success in such a tough mission that many goverments fail to achieve, we must find a mighty theory to support us.

IMHO, to me it appears like the paradigm on which the current Peg definition is constructed has been experimentally proved to be non robust – liquidity provision based on BTC and other crypto walls.

This is a great info – we need now to move on to the fiat only pairs.

Politeness counts – but it is secondary –

What matters on top, is integrity.

I have no issue with the word “firing” and the action that ensues from it, as long as it does not break any motions, and/or it is in agreement and authorized by contracts, rules, motions, terms or any kind of provisions that the concerned parties may have agreed upon

This.

Any violation of any motion that you have seen?

Absolutely – Crypto pair LPC-based Pegging is broken.

How to have a sustainable and profitable pegging business that gives me the incentive to be in?

@JordanLee,

just hoped you have said something since the introduction of gateways (some months ago)

when we used variable spreads in order to support the peg in dire situations.

Moreover, you cannot fire gateways or pool operators!

You just dictate them how to operate. As a gateway operator i follow FLOT’s strategy

in favor of NU.

I believe you have already made a motion about the 1% spread. So have others.

Nushare holders are voting. This motion have no reason to exist but we are always free to make motions

I want to win, but you’re kinda reminding me of Steve Jobs right now. He was brilliant, but ruthless and rubbed people the wrong way by acting like a jerk. We can do what must be done without resorting to childish name calling and firing a whole team of people because of one slip up.

We need these people. They’re active and most of all trusted. Who will you replace them with? There’s only so many people in our community that have the time to do this as well as the reputation. We can’t hire unknowns for such an important job.

The discretion given to FLOT simply got out of hand and major decisions were undertaken without direct approval from shareholders. These people slipped up, but we can still trust all of them to do their jobs and I believe they will comply with any motion passed by shareholders.

If you still feel so strongly about handing down consequences, alter your motion to switch from firing to suspension of duties for a period of time you deem necessary. Also remove the personal insults. Then maybe I will consider voting for it.

I believe it would be best though to just ignore this motion and instead vote for your 1% motion, dictating to FLOT members what they need to do. If they don’t comply, then we can hand down punishment. Passing your 1% motion would still be making a statement to NuBit users.

F. A. Hayek already told us how to do business, he even taught us shrink/expand currency supply with short-term lending. Unfortunataly, only a few on this forum read his book.