more 1000 BTC volume days on NSR would sure improve the social mood of the project.

How about 2 days in a row over 250 BTC per day? Good enough? The recovery is getting noticed.

Over the last two days, in large part due to the NSR rally, we have been able to take quite a few steps in our transition from being a floating supported currency to our normal position as a strongly and tightly pegged currency.

-

In the last 24 hours, the price of US-NBT has ranged from $0.973 to $1.003.

-

There are $7000 in buy orders for US-NBT at or above $0.995.

-

Only 13,000 US-NBT is on the sell order book in front of shareholder offered US-NBT. Once we begin to sell shareholder US-NBT again, proceeds will go immediately to forming a strong buy wall. Good interest can be had for holding and parking NuBits. Shareholders are on track to offer 10% return for 6 months (20% annually) in three days time.

Hi @Cybnate. I respect the many contributions you have made to the project over the years. I’m not sure how to proceed. I am concerned that you lowered the peg in late May. It might be that you would be better suited to work outside liquidity operations, or it may be that you have learned something over the past few months.

-

Based on the BTC price right now, the price of US-NBT has ranged from $0.993 and $1.001 in the last 24 hours. That’s a good peg.

-

There are $12000 in buy orders for US-NBT at or above $0.995.

-

Only 10,000 US-NBT is on the sell order book in front of shareholder offered US-NBT.

The peg has improved in strength over the last day.

Does anyone know how many NBT in circulation now?

Let’s calculate it. The liquidity operations team has 170,881 US-NBT not in the addresses listed in @mhps’s money supply calculation script. @mhps can you calculate the money supply with this info?

We have sold our first US-NBT since the peg was abandoned in late May. When we sell US-NBT from liquidity operations, the funds become part of our reserve and are used to place US-NBT buy orders at $0.995. We have begun the transition from filling our reserves with NSR to filling them with US-NBT. That is where we want to be.

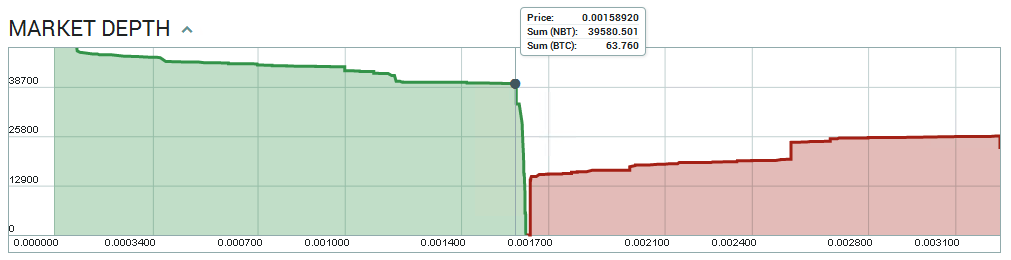

The US-NBT price on Poloniex has stayed within the $0.995 to $1.005 range for all of the last 24 hours. There are $5600 in buy orders at or above $0.995 and an impressive $39,000 in buy orders above $0.975. That is probably more than 13% of all the US-NBT in circulation. It is huge buy support. The peg is getting stronger every day.

Impressive.

Well, I have no idea where you got that story from, but as said before it is not true.

I’ve operated under this grant: https://daology.org/proposals/efb13a1053b26c5770eac5b8ca6c5b994619069e and haven’t deviated from it. I give you the opportunity to use my existing infrastructure based on a solid track record. I don’t want or need to be in the lead, just spreading the risks by providing a service according to motions passed by shareholders.

Will leave it with you to take this opportunity or not. The only reason I’m doing this is because I believe in a pegged cryptocurrency, being a big shareholder and like to be at the forefront of cryptocurrency technologies. Therefore I like to support it.

Will have to renew a few services by the end of this month. If you haven’t responded by then I will decommission it. Else I will submit a motion for voting.

I have investigated these competing claims a bit by reviewing posts from late May and early June. I found this from June 1:

I can't change the offset or the spread according to the motion. I was thinking of submitting a motion to make the offset variable/subject to FLOT guidance/decisions.

I can’t find supporting evidence for my claim, but I did find some for yours. I think perhaps my claim was based on some comments you made to @masterOfDisaster that appeared supportive of him lowering the peg. However, that is different than doing it yourself.

While I honestly thought my claim was factually correct, it wasn’t. That means I have been unfair to you @Cybnate. I’m sorry for that and wish I hadn’t made the mistake. Now that it is cleared up, I would like to have you join the liquidity operations team. Were you operating on more than just Bittrex? Will you propose a contract similar to what you have done with shareholders?

Let’s get liquidity on more than just Poloniex. We are ready to begin using NuLagoon Tube as well. @henry there are few specifics that need to be negotiated regarding that. I will contact you about those momentarily.

I think perhaps my claim was based on some comments you made to @masterOfDisaster that appeared supportive of him lowering the peg.

At that time it appeared to be the best way to defend the peg. Remember that the selling of NSR was delayed. In hindsight I probably should have pushed harder to sell more NSR immediately. But that was not deemed an attractive scenario at the time as there was no adequate source of income, only high liquidity expenses. I did stick to the shareholders’ approved motions though as you found out. I hope we all agree that we have a few lessons learned from that time.

I’m sorry for that and wish I hadn’t made the mistake

We are all humans and we keep on learning.

Now that it is cleared up, I would like to have you join the liquidity operations team. Were you operating on more than just Bittrex?

I have funds on Bittrex and Poloniex. See this thread for the latest status and tier distribution.

Will you propose a contract similar to what you have done with shareholders?

Will draft a proposal for the 2 existing gateways anyway.

Also like to hear your opinion about re-instating liquidity pools. Maybe the cost/risk model doesn’t provide the ROI we are looking for. Woolly’s new liquidity pool software offers more options though which we haven’t been able to fully explore. I still have a running VM with an instance of Woolly’s liquidity pools software which can be activated reasonably quickly if required. If it is no longer valuable in your opinion I like to decommission it to reduce costs.

There are now over $16,000 in US-NBT buy orders on Poloniex above $0.995. There are over $2000 of buy orders at $1.002. There is a total of $41,000 in buy orders at or above $0.96. That is very strong support of our currency, which has a money supply somewhere near 250,000. Approximately 7% of the entire currency supply could be sold at Poloniex without breaking peg.

We can regard the peg as having full strength when reserves are at the prescribed level. Until then, we are still in some degree of transition from being a supported floating currency to a strong and rigid peg.

Accessible reserves are only around $3700 right now. We do have about $25,000 in reserves being held by @masterOfDisaster and BTC FLOT in addition to that. As Chief of Liquidity Operations, I ask that @cryptog, @Dhume, @dysconnect, @masterOfDisaster, @jooize, @mhps, @ttutdxh, @woodstockmerkle coordinate transfer of all BTC funds under control of @masterOfDisaster and BTC FLOT to BTC address 1L55nYrmDEVSmwrLRBkXDCRc7kRJ9YDKVP. This is @jooize’s Poloniex gateway deposit address, so funds will immediately be placed on the buy wall. @ jooize, will you confirm this is your Poloniex gateway address please?

Who will create the BTC FLOT transaction?

With these funds we could have more than $40,000 in buy support at or above $0.995. That is a strong peg. We could buy back more than 16% of the money supply without losing the peg. Let’s do it people. Stop the fighting and start cooperating.

to BTC address 1L55nYrmDEVSmwrLRBkXDCRc7kRJ9YDKVP. This is @jooize’s Poloniex gateway deposit address, so funds will immediately be placed on the buy wall. @ jooize, will you confirm this is your Poloniex gateway address please?

Correct.

Poloniex Gateway @jooize: 1L55nYrmDEVSmwrLRBkXDCRc7kRJ9YDKVP

We are all humans and we keep on learning.

Speak for yourself. My wiki clearly states I am a long-lived bird that is cyclically regenerated or reborn.

Also like to hear your opinion about re-instating liquidity pools.

Decentralization has important benefits. However, we learned in June that the decentralized liquidity provider model we employed was deeply flawed, because the model resulted in a complete halt of funds in tier 4, 5 and 6. It is a failure who’s price appears to be settling out at around 800 million NSR. That means we have spent as many resources mitigating this halt of liquidity as we have on every other endeavor in the entire history of Nu. All the funds paid to Jordan Lee, sigmike, Eleven, desrever, woolly_sammoth, other developers, Cybnate, henry and all liquidity providers combined are less than what we paid to fix the freeze in liquidity. This means preventing this type of colossal waste needs to be our paramount concern. Decentralizing liquidity operations again is a long way down the priority list.

The decentralized nature of our network remains unchanged. None of the changes I have instituted in liquidity operations requires a protocol change. The basic deal and mode of the network remains unchanged. Transaction processing, voting of all kinds and most importantly, the allocation of custodial grants remains completely decentralized and unchanged from how it worked in 2015.

The essence of the change I was able to convince shareholders to make a few months ago is that liquidity operations must be guided by experts. It requires specialized knowledge very few possess. This will never change. Liquidity actions in Nu will always require expert guidance. We must never permit non-experts to be in control again.

I would prefer decentralized liquidity providers follow expert instructions. That didn’t happen in June. An architecture to ensure decentralized liquidity providers follow policy derived by experts is not known to me.

To sum up, I would like decentralized liquidity. However, reliable and cost effective liquidity is a much, much higher priority.

@Cybnate what do you think about liquidity pools at this point?

An architecture to ensure decentralized liquidity providers follow policy derived by experts is not known to me.

I have an idea, the LP experts takes charge of guiding liquidity providing while the decentralized providers use their own money to follow.

How about park some NSR to get some NBT from protocol? The problem is how to reward those decentralized LP.

My wiki clearly states I am a long-lived bird that is cyclically regenerated or reborn

How could I have missed that! It is a strange bird indeed.

The essence of the change I was able to convince shareholders to make a few months ago is that liquidity operations must be guided by experts. It requires specialized knowledge very few possess. This will never change. Liquidity actions in Nu will always require expert guidance. We must never permit non-experts to be in control again.

Expert guidance is always beneficial, however we do lack the abundance of that and we probably can’t afford it.

I would prefer decentralized liquidity providers follow expert instructions. That didn’t happen in June.

I believe one of the issues was that there was inadequate expert instruction or at least not unambiguous.

An architecture to ensure decentralized liquidity providers follow policy derived by experts is not known to me.

That won’t be easy indeed as the expert guidance/vote would likely need to be captured in the blockchain.

To sum up, I would like decentralized liquidity. However, reliable and cost effective liquidity is a much, much higher priority.

And how are you going to deliver that liquidity. With the gateways as per my proposal?

@Cybnate what do you think about liquidity pools at this point?

I think there is tremendous value in a participative liquidity model with decentralised liquidity provisioning. The question is whether Nu can afford it. Sabreiibs model (in this thread) is something to explore and not that different from what we have done before. The difference can be that expert set the parameters for the grants/motions for the pools and that decentralised LPs use their own money in those pools or gateways.

As said the challenge is the cost of this to the network. The risks of providing liquidity on centralised exchanges in NuBits and volatile Bitcoins is relatively high. Providing those funds by the network itself doesn’t take those risks away, they still exist and will eventuate and result in losses for Nu, they are just not immediately monetised as decentralised liquidity provisioning costs. Shareholders tend to prefer rolling steady instead of having shocks, paying for a certain amount of risk transfer for liquidity provisioning on centralised exchanges with volatile currencies fits into that.

The alternative has been raised by mhps several times in the form of direct fiat gateways. At least it addresses the Bitcoin volatility risks and should therefore be cheaper to run over time.

The alternative has been raised by mhps several times in the form of direct fiat gateways. At least it addresses the Bitcoin volatility risks and should therefore be cheaper to run over time.

Let decentralized LP park their NSR and borrow some NBT, then provide LP on FIAT gateways with spread trading, ie. make them become exchange dealers, self-reliance.

The NBT cap. almost below NSR cap from late 2014 to May 2016. It’s proven that we cannot issue more NBT than NSR’s cap. So why not go “pledge”?