Paying for tier 1 liquidity is an open end obligation to pay as well. Liquidity needs to be paid for immediately, parking rates in the future.

Raising parking rates only in case of danger for the peg is less reliable than activity on tier 4 and tier 6.

Is parking rate really more expensive than paying for tier 1 (sell side) liquidity?

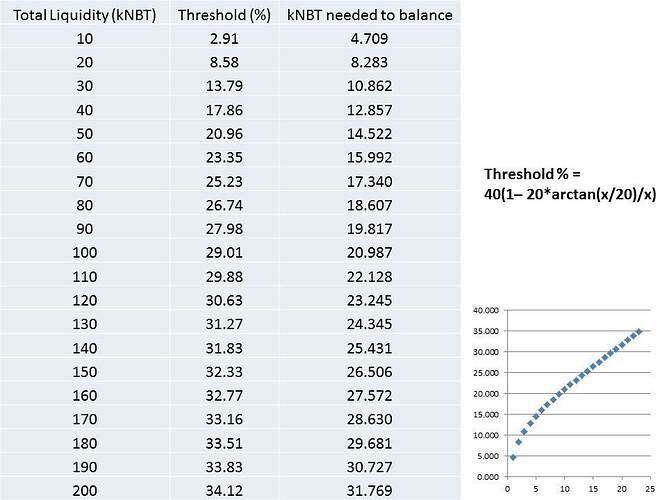

NSR holders can find out how many NBT get parked for x% per month and compare it with compensation for tier 1 liquidity.

If you pay 10% per month for $x (tier 1 sell side) liquidity, you have 1.1 times $x at the end of the month - the same is true for paying 10% interest for 1 month parking.

My gut feeling tells me that in the end “emergency short-term insanely spiked interest” is more expensive than offering decent interest continuously and not necessarily more expensive than compensation for tier 1 liquidity.

This is a rather extended side note, but I wanted to shed light on my perception of it.

My understanding is that

- parking rates (tier 5) should have a mid-term to long-term effect,

- NSR sales (tier 6) a short-term to mid-term effect and

- BTC sale (tier 4) an immediate effect on reducing the sell side.

If you remove NBT in excess from the market (paid for liquidity or interest) by exchanging them for NSR in a continuous process, you likely get more NBT for the NSR compared to selling NSR in a situation in which the peg is under pressure; which means it’s cheaper for Nu.

Selling NSR in case the peg is threatened is still possible.

Maybe my thinking is flawed, though.

I agree.

Dealing with an hourly increasing market velocity might be the hardest part of that, because it would require frequent activity of the custodians. I doubt that is possible.

Or do you mean selling NSR once a day with the resulting $ of the formula $5/h? That should be possible, especially if different multi signature addresses are used. For managing only several hundred to a few thousand $ value 2-of-x or 3-of-x should be fine. The big amounts should require more custodians and a majority of total signers.

And once again I think how beautiful it would be to have seeded auctions for that, send NSR once a day to the auction, put a current status (=NSR market rate) and the remaining time of the auction on the auction website or on nubits.com and exchange NBT for NSR that way!

The ability to bring tier 6 funds to market needs to be delegated to custodians (the future tier 4 fund managers?). Shareholders can grant NBT or NSR, but the process to sell them is not ready yet.

This would be a start in the right direction.

@Nagalim’s proposal is simple and efficient.

What do the other potential tier 4 fund managers think of that?