So here’s how I imagine this happening, in chronological order:

-

JL continues to operate T4 BTC reserve, keeping it under $80k.

-

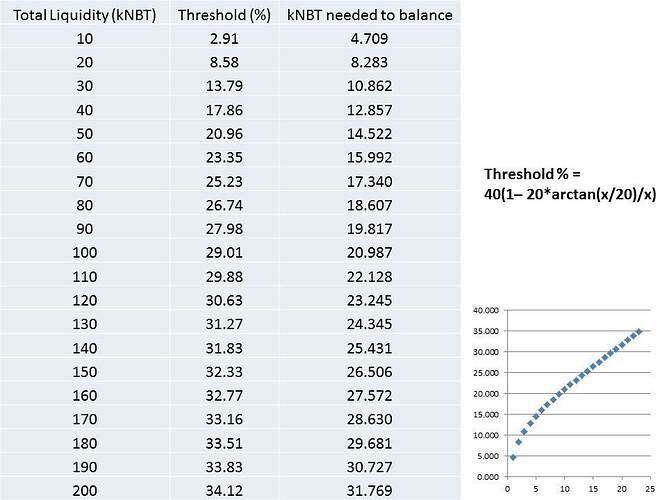

We set up a multisig NSR address (T6). This group is given 5% of the NSR supply (42mil NSR) with the instructions to sell a portion of them for NBT if buy side liquidity in T1-3 goes below $80k while sell side is above $100k (or if buy is <40% of total and total is <$100k)

-

We set up a multisig NBT address (T6). This group is given 5% of the NBT supply with instructions to sell a portion of them for NBT if sell side liquidity in T1-3 goes below $80k while buy side is above $100k (or if sell is <40% of total and total is <$100k)

-

If either group has >6% of their respective marketcap, they burn back down to 5%.

-

Setup up a multisig BTC address for T4. Give this group instructions to buy and burn NBT if buy side liquidity goes below $20k and sell side is above $40k (or if buy is <25% of total and total is <$50k)

-

T4 can at any time mobilize to buy and burn NBT that is being sold for <$0.9

-

Develop smart contracts using the T4 multisig such that we can immediately pay developers to fix dire problems if they arise. Also, any other clever contracts with developers we can think up.

-

Make T4 NSR or NBT reserves if there’s any kind of desire amongst developers to be paid this way.

By step 4 we have a functioning T6. By step 6 we have a functioning T4. Multisig signers can of course use their best judgement on any of the above rules, making bugs in the client or liquidity reporting not as big of an issue (human oversight).