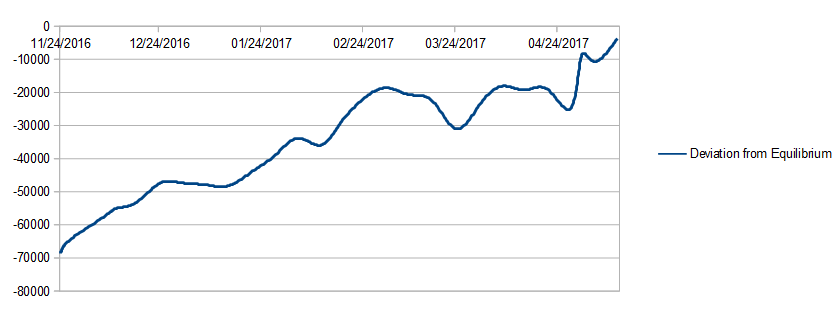

Here is the latest chart of the deviation from reserve equilibrium, which we use to determine whether we do NSR buybacks or NSR sales each day. When the figure is negative, we sell NSR each day, in the amount of 1% of the deviation. When the figure is positive, we buy NSR each day, in the amount of 1% of the deviation:

We have moved from a nearly $70,000 shortfall in November to one just under $4000. This means daily NSR sales have become quite small, currently just $40 per day. Late last year there were periods where we averaged more than $5000 per day in NSR sales. The reduction in the NSR sales have been massive, and if the trend continues, we will soon be performing NSR buybacks, which will start as soon as the deviation becomes positive.

love it!

love it!