I don’t agree. I think the biggest value is that T3 can do the daily fire fighting which FLOT is unsuitable to do. The peg was broken on Polo on Jan 12 because there was one signer less for several hours.

I think we are on the same page.

You are so right.

And I don’t you whether you can believe that or not: I’m amongst those who hates that the most.

I have explained in greater length why I see no viable alternative at the moment in the motion to create a dual side NuBot on Poloniex.

I partially don’t agree with this.

The operational nature might be similar, although I hope for a transition to an unfunded (and only one side funded if need be) dual side bot soon, which would make even the operational nature different.

What already is completely different, is the amount of money.

1,250,000 NBT were under control by jmiller and ktm.

Only a fraction of those were on exchanges; not only one exchange - exchanges!

I’m only pleading for

- supporting one exchange

- with several thousand USD buffer until T3 custodians and fixed cost can prove their effectiveness

- to keep the peg at the most important exchange at present

- and as soon as possible, withdraw funds from the dual side bot to make it a standby emergency solution

The first time I saw the walls went thin, I hesitated, when it came to my mind that I could use gateway proceeds to support the peg. I had to convince myself, that I’m doing the right thing, although it violates the terms of the gateway, before I finally put the gateway proceeds on order.

The next time the walls were drained, I had to do the same thing.

It feels awful being torn between the attempt to do the right thing and following orders.

But as long as there are no other gateways - and I have no idea how else to support the peg efficiently on Poloniex - I don’t see alternatives except for

- don’t care

- hope that only professional traders using bots and price feeds trade on NBT/BTC and just don’t buy outside a certain spread from the price

We could see some days ago that we can’t rely on the latter one.

And I’m just not able to not care.

I only already converted a gateway to dual side mode, because of my assessment that can be found in the motion and because I just can’t keep the pace any longer and I’m not sure about other FLOT members.

If we could look at the data ALix collected over the past few days, you could see how thin the walls have been on Poloniex for an extended time.

The NuBots I operate don’t create order sizes bigger than $3,000. If you find $3,500 on order in total, you know how dire the situation was.

If somebody wants drama, the edit history of Current Liquidity has some,

I’m not taking it easy, I just lack the alternatives. T3 custodians are great. We need more than just one.

Once a dual side bot (I hope that by then I won’t be the only one operating one) is in active standby (running, but unfunded), T3 custodians can fund it if need be. They have singlesig addresses, in difference to FLOT. And conceptually, it would be exactly within the “waterfall scheme”:

T4 -> T3 -> T2 -> T1

FLOT funds T3 custodians, they send money on exchange, NuBot puts in on order.

That’s just a shortcut if there’s no time to lose.

My impression was that KTM and jmiller had 10k - 20k on an exchange at a time. It’s true that they had more fund off exchange and took care of multiple exchanges. What I meant was that on one change there were 10k - 20k so if that exchange was down that amount was in danger. You held 10k+ on an exchange so I saw the similarity.

Their operations were bigger than yours, but the “specific risk” - risk per exchange mishappening - is the same.

The difference between gateways and LPs is in the fund risk.

Gateways put in risk NU’s funds.

LPs put in risk their own funds.

Which can recover more easily after an exchange default?

I wonder

That is why i think that FLOT+gateways are more appropriate to keep the peg plus all the LPs that can be available.

There is a clear similarity. You are totally right about that.

And I dearly hope you took no offense from my last post. While it was in reply to your post, it was addressed to all NSR holders.

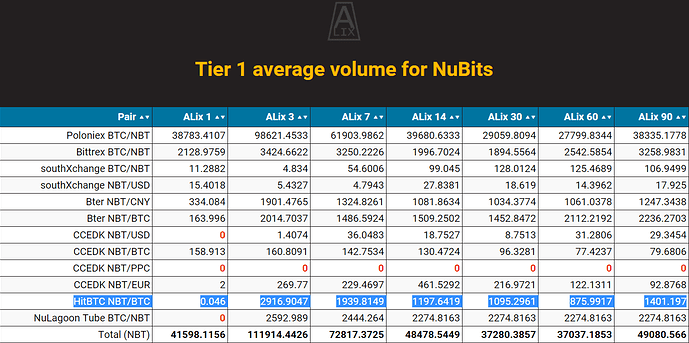

Here’s a snapshot of jmiller operation:

This is close to $70,000 on exchanges.

And this is from the CCEDK operation of ktm (was too lazy to dig for more information):

Back then were hundreds of thousands at the exchanges.

Just look at the reports of Kiara:

https://gist.github.com/KiaraTamm

All I’m pleading for is for some thousands of USD on one exchange, which is the major exchange at present until the liquidity provision could be improved.

But there are differences as well.

jmiller and ktm were being paid to monitor the liquidity situation and act if funds run low.

I don’t receive any compensation for operating the gateways, monitoring the liquidity situation and feeling bad for doing the right, albeit not allowed things. I don’t even want it. I just want to help improving things.

I have a vision of Nu being a boon for the world, limiting the power of central banks. I perceive US-NBT, EU-NBT and CY-NBT as another transition.

It would be great to arrive in a world, in wich X-NBT is in a dominant position - that way no single central bank could try to fool the rest of the world with it’s monetary policy.

That’s what fuels my passion.

I meant it when I wrote that I’m tired…

no offense taken. collective memory needs to be refreshed. you are doing great.

It might be good to not only foster T3 custodians (collateralized operations), but increase the number of MLPs at important exchanges.

I applied for a role as LP at hitBTC, because I thought liquidity might attract users.

If I look at ALiX, that didn’t really work out.

I don’t really know why. hitBTC is a great exchange with formidable performance and the ability to differentiate between a main account and a trading account is awesome (although that makes running an automatic gateway there impossible)!

At the moment NuLagoon is still running an operation on hitBTC.

The last term of modPuddle on hitBTC ended a few days ago and while I intended to make another term, I had to stop the operation to use the NuBot for Poloniex.

I’m going to draft a motion to provide liquidity on Poloniex with NuBot. The terms will be similar to the hitBTC terms. I will reuse the custodial address of the hitBTC grant.

It’s a philosophical question whether Nu wants to support the most important exchange in this way, maybe making it even more important for Nu and Nu more dependent on it, or to invest efforts trying to make other exchanges important.

My answer is quite simple: Nu can only make business where the customers do business. That’s currently Poloniex.

Providing a means of hedging volatility for traders can’t stay the main business of Nu. Everyone’s aware that this is no sustainable business, but it’s a kind of marketing to show the world that Nu is here and its products work like advertized.

As long as Poloniex is that important, I feel uncomfortable relying solely on ALP (and NuLagoon? Is NuLagoon operating on Poloniex? And if so, why was the situation as dire as it was…) to keep the peg at Poloniex.

I encourage all to think about becoming MLP. One MLP at Poloniex isn’t enough. Other exchanges have need for MLP, too.

It will increase the reliability of liquidity provision. That’s depending on the terms; my terms will offer funds reliably for a period of time.

If the main risks (hedging, (total) loss of funds due to theft, exchange default, etc.) are the same when operating ALP or MLP, the compensation will be comparable.

There will only be an uplift required for the reduced flexibility if you devote funds for an extended period of time (and maybe some compensation for efforts if they are increasing the product quality, e.g. balancing sides, etc.).

Another (potential) benefit is, that MLPs dealing with T3 custodians can reduce friction in the liquidity flow even further.

I’m looking forward to future versions of NuBot, which are market aware, and can shift the order offsets depending on the price trend, to reduce the hedging risk for LP.

That’s correct. “Bring the walls and they will come” failed totally.

It didn’t work on Bittrex.

And it didn’t work on CCEDK. Have a look at the volume on CCEDK pairs. Keep in mind what we’re paying for about 200 NBT of volume per day (90 day avg.) on 4 pairs.

We need a paradigm change here. Quick.

Are you asking decentralization or centralization? My answer is decentralization. So invest in competent multiple exchanges.

Centralization can be intoxicating. So efficient. But no thanks. A diverse ecosystem first. Champions second.

You are right. But how to solve that Gordian knot?

Would you limit the success of NBT at Poloniex by offering a worse product (bigger offset)?

How shall we increase adoption at other exchanges unless with offering liquidity, which we already do?

I would. a cryptocurrency is a worse product than Visa i most metrics. But we keep working on cryptos. Bigger offset is OK for traders. That 0.5% difference in profit is nothing to fret about.

Bittrex and CCEDK are not just small nubits exchanges. They are small exchange period. We should aim for expanding into exchanges in the top 15 BTCUSD and top 5 BTCCNY at CMC. We should get @miner and @wengone to check out possibility to have nubits on okcoin, huobi, btcchina, @cryptog ans @crypto_coiner on btcbox … That is also “make business where the customers do business” @tomjoad may have suggestions on that.

I ll try to contact btcbox.

I know the ceo of bitflyer and the team at bitbank also…

I am based out of Japan, but I am connected professionally to virtually all exchange in the world (CEO, CTO or CMO), by virtue of my daily job.

Before contacting them, I certainly need and prepare a solid message that will convince them of the obvious business incentives to adopt and integrate Nubits.

This is a good start:

I agree.

We can always offer bigger compensation in order to make LPs risk their money in exchanges that require a lot of liquidity.

The interest rates in Polo for ALP should be much higher than in other exchanges. Of course this will “help” in

"centralizitation" but it would also help Nu keeping the peg.

i second that. i feel nulagoon is absent from poloniex!

The fixed cost scheme will help big time here.

But I don’t think it needs to be something special for Poloniex.

Fixed cost can improve liquidity provision at each exchange, because as long as a minimum liquidity is available, the peg is safe!

And even if not the full total compensation is paid, if the volume on order is below a certain threshold (or maybe the compensation is raised in steps), providing liquidity needs to be especially profitable, if the volume on a side is low and the danger for the peg big.

I’m thinking of something like a “parametric compensation scheme” that was already sketched in another thread.

Liquidity provision must be more rewarding if the walls start to run dry, because the risk for the peg is getting bigger. The monitoring and the effort to act in such situations must be worthwhile.

A failing peg has a price, too, although we don’t know it.

I’m not sure whether Poloniex was ever supported by NuLagoon - I just thought so!

I think it will be good to have open-source tools for custodians to run multi-sig pools off-exchange. This will be important along the line of heavy-duty subsidiary applications like NuBot and NuPool.

A rough idea is as follows:

Suppose Alice and Bob jointly run NuBooth, a semi-distributed market-marking off-exchange platform. It allows people to deposit NBT to get BTC and vice versa via Blockchain transactions.

In order to reduce risks, NuBooth addresses are 2-of-3 multisig addresses, where one private key is in cold storage by another trusted third party (or whatever arrangement that has both multisig security and robustness against loss of private keys).

Being multisig, they both need to sign a transaction in order to deliver funds to their customers. They should be separate entities for this to make sense, and this inevitably leads to a discrepancy in price feeds.

First I note that I want to put in a market-maker element for ALPs. We need to be able to get people to buy at non-arbitrage pricing, or Nu will risk an eventual break down by excessively subsidizing cryptocurrency speculation. So a crucial difference between this and NuLagoon Tube (apart from the availability of pool funds) is how the selling price is determined. The crux is that NuBooth will always be on the safer side of the trade, and try to avoid trades when there is a large discrepancy between price feeds.

A rough work flow is as flows:

-

I send in 1 BTC without replace-by-fee.

-

Alice and Bob each has a price feed, sees the unconfirmed transaction and starts tracking the lowest “real-time” non-arbitrage selling prices of NBT based on their feeds, Alice tracks p_1a,p_2a,…,p_Ta; Bob tracks p_1b,p_b,…,p_Tb.

-

If Alice sees that the 1 BTC is confirmed at time T,a she computes compute the highest values p_max(a) and lowest value p_min(b) among all p_i’s and sends them to Bob. When Bob sees that the 1 BTC is confirmed at time Tb, he does the same, computing values p_max(b), p_min(b) Suppose Ta < Tb, in which case Bob also sends in his prices.

-

Because Bob receives the price pairs from Alice first, once he works out his own prices he will decide whether to propose a transaction. If the range of the 4 prices exceeds say 1% he will decide to refund my 1 BTC and tell that to Alice, in which case the refund transaction is signed. Otherwise he will propose a transaction at the price point max(p_max(a),p_max(b)) and ask Alice to sign it.

Due to the pricing issues I don’t think this will be high-volume; however, as long as a service like this is live and known, we do not have to worry about the peg being at risk when liquidity is low on main exchanges - we readily provide non-arbitrage price that is slightly biased to ourselves, effectively organically applying a “spread” to adjust for the occasion.

When BCExchange comes out, the multisig-part might not survive, but the non-arbitrage element will still be needed and refined.

I think that T3 custodianship with collateral is much better than without.

I expect the other T3 custodianship proposals to include a collateral in order to pass.

Also, I was thinking: does it mean make sense to impose a collateral to gateways?

If it involves Nu’s money, I think it should.