I’m sorry, I don’t understand how that is different from what’s currently being implemented. BKS holders vote on the BKC Tx fee such that the fee must be paid /KB. This is the same type of fee as the dust fee that PPC implemented from the beginning, the only difference is that we will be using it as a source of profit in addition to preventing blockchain bloat. But it’s still a flat fee per Tx that shareholders vote on.

…a fee per byte of TX size!

"Transaction fees will be adjustable like Nu 2.0 but charged on a per byte basis instead of per kilobyte."1

As the BKS holders will be able to adjust the type of multi signature transactions to move funds ("Shareholders will vote on the number of signers and the number required to move funds (such as 4 out of 7 or 6 out of 10), up to 15."2) and the "maximum trade size permitted by asset ID"3 they have pretty good control of the minimum fees that customers need to pay for using the BCE blockchain.

A lot of the design has been adjusted since the release of the design document, but I think this kind of control is still on the agenda.

1 source: https://nubits.com/sites/default/files/assets/Blocks%20%26%20Chains%20Decentralized%20Exchange.pdf, page 4, 3rd paragraph

2 source: https://nubits.com/sites/default/files/assets/Blocks%20%26%20Chains%20Decentralized%20Exchange.pdf, page 7, 2nd paragraph

3 source: https://nubits.com/sites/default/files/assets/Blocks%20%26%20Chains%20Decentralized%20Exchange.pdf, page 3, 2nd list, 4th element

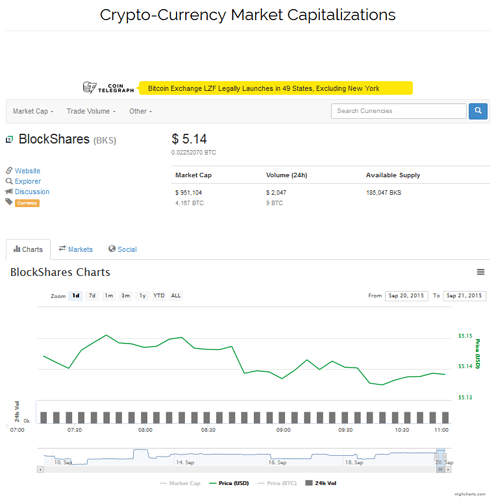

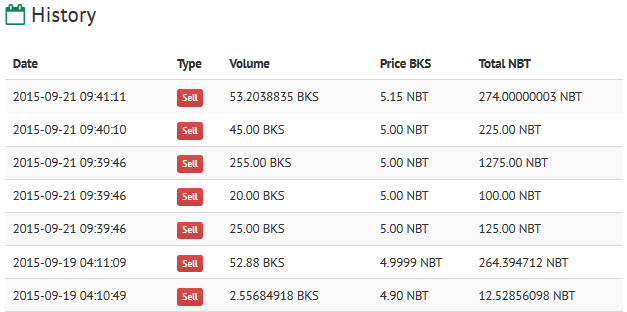

CCEDK has implemented proper BKS/NBT and BKS/BTC trading pairs, which means that coinmarketcap.com should be displaying the market cap of BKS very soon. The more effective display of BKS trading pairs on CCEDK should encourage price discovery I think.

What does everyone think a realistic price target is in the coming months?

I think one could only have a proper answer when we have a functioning product we can show and everyone can use.

I’d say it can go to 6~7 dollars although that should be extremely speculation based

I know I’m a lone voice, but I’m uncomfortable with BKS trading on any centralized exchange when B&C isn’t up and running yet. I think it puts the project in a bad light as it gives BKS speculators incentive to hype and profit. This is what’s currently going on with Bitshares and Ethereum and it strikes me as beneath the professionalism of this community. It also seems odd and unfortunate that BKS should begin its trading on a centralized exchange, as such operations are squarely in the crosshairs of B&C. It would have been awesome to see BKS commence trading simultaneous with the launch of the new exchange. I just don’t see much upside of having BKS begin trading so soon, particularly since the BKS offering accomplished its goal of getting B&C development funded. Price discovery makes most sense when the product it values becomes available.

Edit: typo

Trade will happen either way. Before we had even announced a finalized blockchain people were talking about trading via escrow. I think we should let the speculators speculate, especially since we ended the IPO. But I hear what you’re saying, hype is not something we should be endorsing.

Still, you can’t just turn off the flood gates. You can’t even hold them back once you’ve announced a finalized blockchain.

Speculating on the future profitability of a business is commonly done in most private ventures. I think the core difference between the BitShares approach and the B&C Exchange approach isn’t the availability of cryptoequity trading prior to full release, but rather the language used to promote the projects. BCExchange and Jordan Lee have continually stressed on Bitcointalk that there are no guarantees the project will ever be completed, although their prior experience makes that outcome more likely than a random project development team. BitShares has always used a series of ridiculous branding messages - including “better than a swiss bank” and having “the speed of the NASDAQ” - that have left its investors perpetually disappointed once the reality didn’t match the hype.

I think as long as B&C Exchange presents a realistic view of the probability of development success at regular intervals it is acting ethically. To my knowledge no financial performance projections have ever been made by the B&C Exchange team.

You are picturing a future where will hopefully arrive at, thanks to BCE.

But this can hardly be achieved without a transition to it; centralized exchanges are a part of this transition process.

And they will stay a part of the overall business model for some more time - at least until there’s a viable way to exchange NBT (or other stable crypto currencies that might be traded on BCE) to USD or other fiat money conveniently, with sufficient volume outside exchanges.

It allows the BCE funders to stay liquid. They can sell the BKS in case they need to or want to. Plus it offers NSR holders who received BKS as dividends to trade them to whatever they like (in case they don’t want the BKS).

That absolutely right and I bet we will see much less fluctuation once BCE has started its trading and reached a stable amount of revenue. The BKS price will then very likely be determined by a decent price-earnings ratio. Before that it’s a BKS price in hope for a future price-earnings ratio, just like @tomjoad explained:

And that’s the interesting part. Finally we have a Peershares DAC that can be treated like a traditional stock corporation in many ways.

We are currently (still) in the venture capital financing phase (and that’s a good reason for BKS to be already tradable) of an auspicious start-up.

Soon there might be the first working prototype; important steps have already been made (e.g. the reputation system).

But only after BCE is fully up, has passed some tests of fire, did prove itself as stable, reliable, safe & sound and shown how much revenue it can really generate, the price may settle to a relatively stable price-earnings ratio.

Typically the (expected) price-earnings ratio is higher in the early phase (where much is driven by hope) of start-ups and can easily be 100:1 (have a look at Facebook’s early days). It might take years to reach the “stable” price-earnings ratio I proclaimed.

I expect the price-earnings ratio of BCE to be around 20:1 after the second year of operation, but have no clue what that will be in NBT - I will make a bet, though - later…

This is just speculation - take it with a grain of salt:

close to 185,000 BKS is the total amount of shares of BCE that is (potentially) available; some of them have been sold by BCE, some paid as dividend to NSR holders, some additional to BTC holders will follow.

The total amount of funds raised (according to the last report) is $312,860.

If there would be no hope for value generated by development, the price per BKS should be $1.69. ($312,860/185,000BKS).

Without going deep into the analysis of the operational costs of BCE (development, marketing, reputed signers, etc.), allow me to blatantly claim that BCE will make $10,000 revenue per month or $120,000 annually.

That is close to two thirds of a Dollar per share revenue.

With a price-earnings ratio of 12:1 that would result in a price per BKS of $12*(2/3)=$8. (I admit to have chosen 12:1, because the math is more beautiful that way  )

)

I can neither foresee the revenue made by BCE (we don’t even know whether it will be finished, work and be adopted by the masses!) nor the price-earnings ratio the market will attach to BCE.

I hope that the expected revenue and price-earnings ratio is not too far off.

Doubling the price in relation to the last sell price and quintupling it to the current total asset price of BCE should very well be possible.

In the early phase after BCE starts making revenue a spiking desire for BKS driven by a big hope for even bigger revenue can easily ten-fold the price-earnings ratio and subsequently the BKS price.

To answer this question

more precisely:

|---------------|--------------------|

| month | nbt/bks |

|---------------|--------------------|

| 10/15 | 6 |

| 11/15 | 10 |

| 01/16 | 20 |

| 02/16 | 50 |

| 03/16 | 100 |

| 04/16 | 60 |

| 05/16 | 30 |

| 06/16 | 20 |

| 07/16 | 20 |

| 08/16 | 20 |

| 09/16 | 20 |

| 10/16 | 20 |

| 11/16 | 20 |

| 12/16 | 20 |

| 01/16 | 25 |

| 02/16 | 25 |

| 03/16 | 25 |

| 04/16 | 25 |

| 05/16 | 30 |

| 06/16 | 30 |

| 07/16 | 30 |

| 08/16 | 30 |

| 09/16 | 30 |

| 10/16 | 30 |

|---------------|--------------------|BCE shouldn’t endorse hype, but it can hardly prevent it from happening - BCE would do well not to fuel hype and that’s what BCE has done from the beginning: under-promise and over-deliver!

…or maybe BCE perishes - who knows?

In BCE I see another corporation that offers a combination of doing something good for people and earning money with it; just like the Nu network, but with an easier to grasp business model.

I hope it succeeds. The crypto world is in need of decentralized exchanges that simply work.

Who knows - in some years from now BCE might have become what NYSE for traditional stock corporations already is

$5.15!

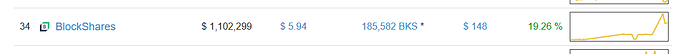

BlockShares eclipses $1,000,000 for the first time on October 29, 2015. The surge in the price of BKS/BTC has been the main contributor to the price increase.

With no vol, i do not think it is that meaningful though, what do u think?

BKS is up to $6.54 with $2000 in daily volume today. Looks like the upcoming release of v 4.0 is generating more interest for B&C Exchange.

And maybe the possibility of a new hire as well.

@ronny, what is happening on that order book?

6.25 in the sell book and 6.50 in the buy book don’t meet?!

Looks like they are not finished with the conversion from NBT to US-NBT.

I noticed today that CCEDK’s US-NBT switch seems to have broken our BKS listing on coinmarketcap.com. I’ve notified CMC of the issue.

If CMC changes NBT to US-NBT could it break all listings on other exchanges?

They already did, so no?